Page 230 - EXIM-Bank_Annual-Report-2023

P. 230

EXIM BANk MALAySIA

228 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

45. ISLAMIC BuSINESS FuNDS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2023

(cont’d)

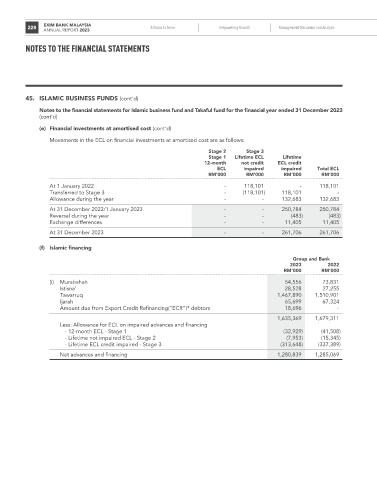

(e) Financial investments at amortised cost (cont’d)

Movements in the ECL on financial investments at amortised cost are as follows:

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

rM’000 rM’000 rM’000 rM’000

At 1 January 2022 - 118,101 - 118,101

Transferred to Stage 3 - (118,101) 118,101 -

Allowance during the year - - 132,683 132,683

At 31 December 2022/1 January 2023 - - 250,784 250,784

Reversal during the year - - (483) (483)

Exchange differences - - 11,405 11,405

At 31 December 2023 - - 261,706 261,706

(f) Islamic financing

Group and Bank

2023 2022

rM’000 rM’000

(i) Murabahah 54,556 73,831

Istisna’ 28,528 27,255

Tawarruq 1,467,890 1,510,901

Ijarah 65,699 67,324

Amount due from Export Credit Refinancing(“ECR”)* debtors 18,696 -

1,635,369 1,679,311

Less: Allowance for ECL on impaired advances and financing

- 12-month ECL - Stage 1 (32,929) (41,508)

- Lifetime not impaired ECL - Stage 2 (7,953) (15,345)

- Lifetime ECL credit impaired - Stage 3 (313,648) (337,389)

Net advances and financing 1,280,839 1,285,069