Page 233 - EXIM-Bank_Annual-Report-2023

P. 233

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 231

Notes to the fiNaNcial statemeNts

45. ISLAMIC BuSINESS FuNDS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2023

(cont’d)

(f) Islamic financing (cont’d)

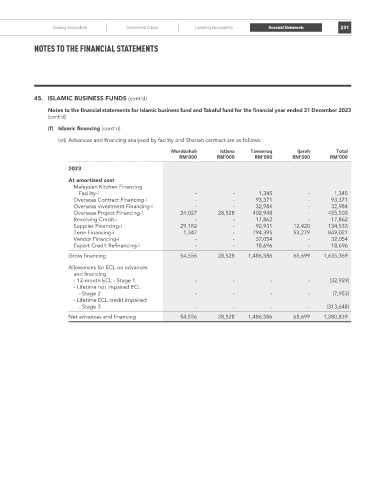

(vii) Advances and financing analysed by facility and Shariah contract are as follows:

Murabahah Istisna Tawarruq Ijarah Total

rM’000 rM’000 rM’000 rM’000 rM’000

2023

At amortised cost

Malaysian Kitchen Financing

Facility-i - - 1,345 - 1,345

Overseas Contract Financing-i - - 93,371 - 93,371

Overseas Investment Financing-i - - 32,984 - 32,984

Overseas Project Financing-i 24,027 28,528 402,948 - 455,503

Revolving Credit-i - - 17,862 - 17,862

Supplier Financing-i 29,182 - 92,931 12,420 134,533

Term Financing-i 1,347 - 794,395 53,279 849,021

Vendor Financing-i - - 32,054 - 32,054

Export Credit Refinancing-i - - 18,696 - 18,696

Gross financing 54,556 28,528 1,486,586 65,699 1,635,369

Allowances for ECL on advances

and financing

- 12-month ECL - Stage 1 - - - - (32,929)

- Lifetime not impaired ECL

- Stage 2 - - - - (7,953)

- Lifetime ECL credit impaired

- Stage 3 - - - - (313,648)

Net advances and financing 54,556 28,528 1,486,586 65,699 1,280,839