Page 216 - EXIM-Bank_Annual-Report-2023

P. 216

EXIM BANk MALAySIA

214 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

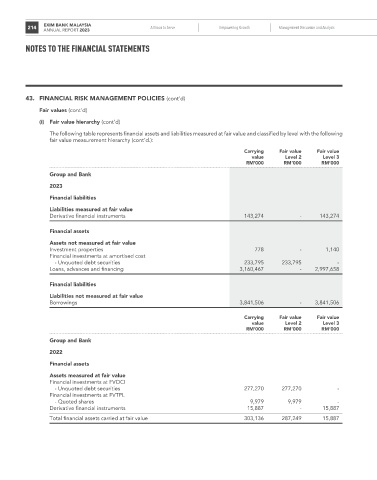

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Fair values (cont’d)

(i) Fair value hierarchy (cont’d)

The following table represents financial assets and liabilities measured at fair value and classified by level with the following

fair value measurement hierarchy (cont’d.):

Carrying Fair value Fair value

value Level 2 Level 3

rM’000 rM’000 rM’000

Group and Bank

2023

Financial liabilities

Liabilities measured at fair value

Derivative financial instruments 143,274 - 143,274

Financial assets

Assets not measured at fair value

Investment properties 778 - 1,140

Financial investments at amortised cost

- Unquoted debt securities 233,795 233,795 -

Loans, advances and financing 3,160,467 - 2,997,658

Financial liabilities

Liabilities not measured at fair value

Borrowings 3,841,506 - 3,841,506

Carrying Fair value Fair value

value Level 2 Level 3

rM’000 rM’000 rM’000

Group and Bank

2022

Financial assets

Assets measured at fair value

Financial investments at FVOCI

- Unquoted debt securities 277,270 277,270 -

Financial investments at FVTPL

- Quoted shares 9,979 9,979 -

Derivative financial instruments 15,887 - 15,887

Total financial assets carried at fair value 303,136 287,249 15,887