Page 214 - EXIM-Bank_Annual-Report-2023

P. 214

EXIM BANk MALAySIA

212 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

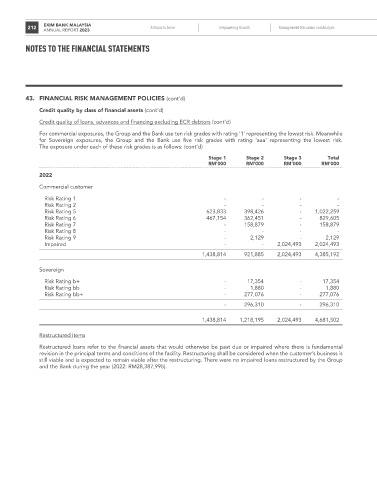

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Credit quality by class of financial assets (cont’d)

Credit quality of loans, advances and financing excluding ECR debtors (cont’d)

For commercial exposures, the Group and the Bank use ten risk grades with rating ‘1’ representing the lowest risk. Meanwhile

for Sovereign exposures, the Group and the Bank use five risk grades with rating ‘aaa’ representing the lowest risk.

The exposure under each of these risk grades is as follows: (cont’d)

Stage 1 Stage 2 Stage 3 Total

rM’000 rM’000 rM’000 rM’000

2022

Commercial customer

Risk Rating 1 - - - -

Risk Rating 2 - - - -

Risk Rating 5 623,833 398,426 - 1,022,259

Risk Rating 6 467,154 362,451 - 829,605

Risk Rating 7 - 158,879 - 158,879

Risk Rating 8 - - - -

Risk Rating 9 - 2,129 - 2,129

Impaired - - 2,024,493 2,024,493

1,438,814 921,885 2,024,493 4,385,192

Sovereign

Risk Rating b+ - 17,354 - 17,354

Risk Rating bb - 1,880 - 1,880

Risk Rating bb+ - 277,076 - 277,076

- 296,310 - 296,310

1,438,814 1,218,195 2,024,493 4,681,502

Restructured items

Restructured loans refer to the financial assets that would otherwise be past due or impaired where there is fundamental

revision in the principal terms and conditions of the facility. Restructuring shall be considered when the customer’s business is

still viable and is expected to remain viable after the restructuring. There were no impaired loans restructured by the Group

and the Bank during the year (2022: RM28,387,995).