Page 213 - EXIM-Bank_Annual-Report-2023

P. 213

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 211

Notes to the fiNaNcial statemeNts

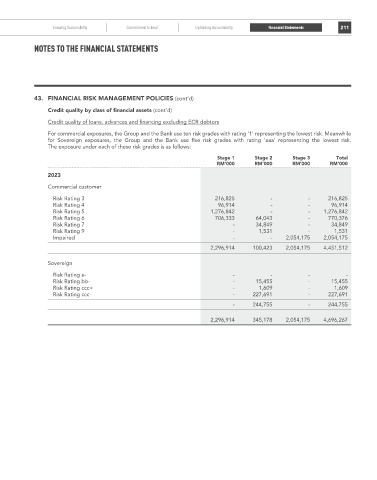

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Credit quality by class of financial assets (cont’d)

Credit quality of loans, advances and financing excluding ECR debtors

For commercial exposures, the Group and the Bank use ten risk grades with rating ‘1’ representing the lowest risk. Meanwhile

for Sovereign exposures, the Group and the Bank use five risk grades with rating ‘aaa’ representing the lowest risk.

The exposure under each of these risk grades is as follows:

Stage 1 Stage 2 Stage 3 Total

rM’000 rM’000 rM’000 rM’000

2023

Commercial customer

Risk Rating 3 216,825 - - 216,825

Risk Rating 4 96,914 - - 96,914

Risk Rating 5 1,276,842 - - 1,276,842

Risk Rating 6 706,333 64,043 - 770,376

Risk Rating 7 - 34,849 - 34,849

Risk Rating 9 - 1,531 - 1,531

Impaired - - 2,054,175 2,054,175

2,296,914 100,423 2,054,175 4,451,512

Sovereign

Risk Rating a- - - - -

Risk Rating bb- - 15,455 - 15,455

Risk Rating ccc+ - 1,609 - 1,609

Risk Rating ccc- - 227,691 - 227,691

- 244,755 - 244,755

2,296,914 345,178 2,054,175 4,696,267