Page 209 - EXIM-Bank_Annual-Report-2023

P. 209

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 207

Notes to the fiNaNcial statemeNts

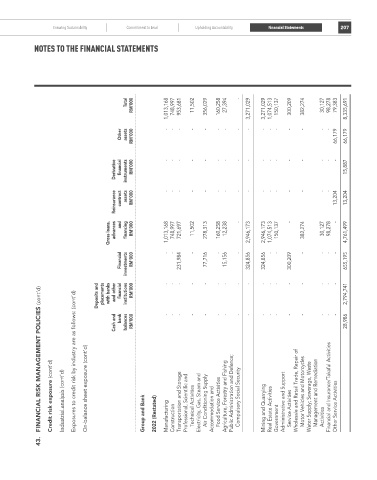

Total rM’000 1,013,168 748,997 953,681 11,502 356,029 160,258 27,394 - 3,271,029 3,271,029 1,074,513 150,137 300,209 382,274 30,127 98,278 79,383 8,335,691

Other assets rM’000 - - - - - - - - - - - - - - - - 66,179 66,179

Derivative financial instruments rM’000 - - - - - - - - - - - - - - - - - 15,887

reinsurance contract assets rM’000 - - - - - - - - - - - - - - - - 13,204 13,204

Gross loans, advances and financing rM’000 1,013,168 748,997 721,697 11,502 278,313 160,258 12,238 - 2,946,173 2,946,173 1,074,513 150,137 - 382,274 30,127 98,278 - 4,761,499

- - - - - - - - - - -

Financial investments rM’000 231,984 77,716 15,156 324,856 324,856 300,209 655,195

Deposits and placements with banks and other financial institutions rM’000 - - - - - - - - - - - - - - - - - 2,794,741

FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

bank - - - - - - - - - - - - - - - - -

Cash and balances rM’000 28,986

Credit risk exposure (cont’d) Industrial analysis (cont’d) Exposures to credit risk by industry are as follows: (cont’d) On-balance sheet exposure (cont’d) Group and Bank 2022 (Restated) Manufacturing Construction Transportation and Storage Professional, Scientific and Technical Activities Electricity, Gas, Steam and Air Conditioning Supply Accommodation and Food Service Activities Agriculture, Forestry and Fishing Public Administration and Defence; C

43.