Page 206 - EXIM-Bank_Annual-Report-2023

P. 206

EXIM BANk MALAySIA

204 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

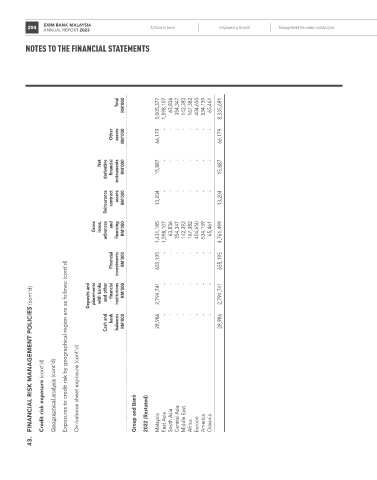

Notes to the fiNaNcial statemeNts

Total rM’000 5,005,377 1,598,107 63,836 354,347 142,392 167,382 404,650 534,139 65,461 8,335,691

Other assets rM’000 66,179 - - - - - - - - 66,179

derivative financial instruments rM’000 15,887 15,887

Net - - - - - - - -

assets - - - - - - - -

reinsurance contract rM’000 13,204 13,204

Gross loans, advances and financing rM’000 1,431,185 1,598,107 63,836 354,347 142,392 167,382 404,650 534,139 65,461 4,761,499

Financial investments rM’000 655,195 655,195

- - - - - - - -

Exposures to credit risk by geographical region are as follows: (cont’d)

Deposits and placements with banks and other financial institutions rM’000 2,794,741 - - - - - - - - 2,794,741

FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

bank - - - - - - - -

Cash and balances rM’000 28,986 28,986

Credit risk exposure (cont’d) Geographical analysis (cont’d) On-balance sheet exposure (cont’d) Group and Bank 2022 (Restated)

43. Malaysia East Asia South Asia Central Asia Middle East Africa Europe America Oceania