Page 196 - EXIM-Bank_Annual-Report-2023

P. 196

EXIM BANk MALAySIA

194 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

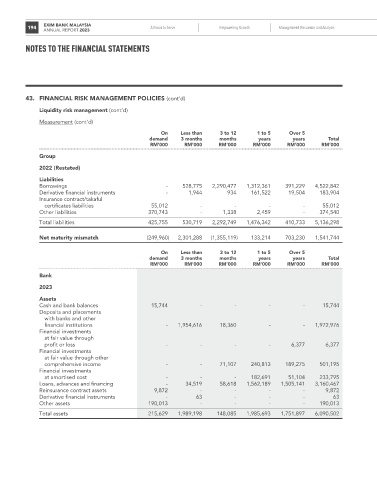

43. FINANCIAL rISk MANAGEMENT PoLICIES (cont’d)

Liquidity risk management (cont’d)

Measurement (cont’d)

on Less than 3 to 12 1 to 5 over 5

demand 3 months months years years Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Group

2022 (Restated)

Liabilities

Borrowings - 528,775 2,290,477 1,312,361 391,229 4,522,842

Derivative financial instruments - 1,944 934 161,522 19,504 183,904

Insurance contract/takaful

certificates liabilities 55,012 - - - - 55,012

Other liabilities 370,743 - 1,338 2,459 - 374,540

Total liabilities 425,755 530,719 2,292,749 1,476,342 410,733 5,136,298

Net maturity mismatch (249,960) 2,301,288 (1,355,119) 133,214 703,230 1,541,744

on Less than 3 to 12 1 to 5 over 5

demand 3 months months years years Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Bank

2023

Assets

Cash and bank balances 15,744 - - - - 15,744

Deposits and placements

with banks and other

financial institutions - 1,954,616 18,360 - - 1,972,976

Financial investments

at fair value through

profit or loss - - - - 6,377 6,377

Financial investments

at fair value through other

comprehensive income - - 71,107 240,813 189,275 501,195

Financial investments

at amortised cost - - - 182,691 51,104 233,795

Loans, advances and financing - 34,519 58,618 1,562,189 1,505,141 3,160,467

Reinsurance contract assets 9,872 - - - - 9,872

Derivative financial instruments - 63 - - - 63

Other assets 190,013 - - - - 190,013

Total assets 215,629 1,989,198 148,085 1,985,693 1,751,897 6,090,502