Page 133 - EXIM-BANK-AR20

P. 133

Section 06 Financial Statements

131

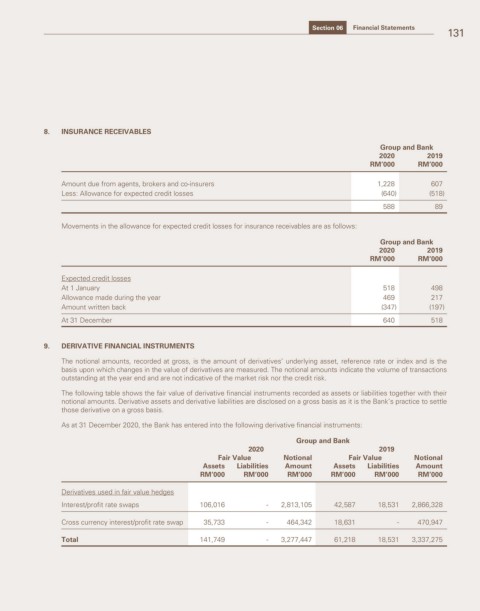

8. INSURANCE RECEIVABLES

Group and Bank

2020 2019

RM’000 RM’000

Amount due from agents, brokers and co-insurers 1,228 607

Less: Allowance for expected credit losses (640) (518)

588 89

Movements in the allowance for expected credit losses for insurance receivables are as follows:

Group and Bank

2020 2019

RM’000 RM’000

Expected credit losses

At 1 January 518 498

Allowance made during the year 469 217

Amount written back (347) (197)

At 31 December 640 518

9. DERIVATIVE FINANCIAL INSTRUMENTS

The notional amounts, recorded at gross, is the amount of derivatives’ underlying asset, reference rate or index and is the

basis upon which changes in the value of derivatives are measured. The notional amounts indicate the volume of transactions

outstanding at the year end and are not indicative of the market risk nor the credit risk.

The following table shows the fair value of derivative financial instruments recorded as assets or liabilities together with their

notional amounts. Derivative assets and derivative liabilities are disclosed on a gross basis as it is the Bank’s practice to settle

those derivative on a gross basis.

As at 31 December 2020, the Bank has entered into the following derivative financial instruments:

Group and Bank

2020 2019

Fair Value Notional Fair Value Notional

Assets Liabilities Amount Assets Liabilities Amount

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Derivatives used in fair value hedges

Interest/profit rate swaps 106,016 - 2,813,105 42,587 18,531 2,866,328

Cross currency interest/profit rate swap 35,733 - 464,342 18,631 - 470,947

Total 141,749 - 3,277,447 61,218 18,531 3,337,275