Page 130 - EXIM-BANK-AR20

P. 130

128 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

7. LOANS, ADVANCES AND FINANCING (CONT’D.)

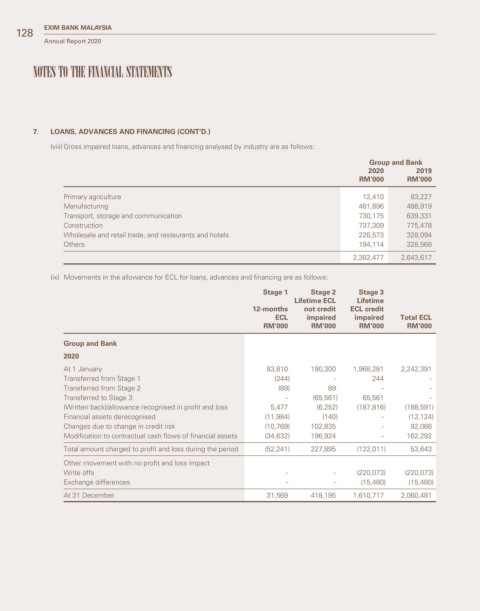

(viii) Gross impaired loans, advances and financing analysed by industry are as follows:

Group and Bank

2020 2019

RM’000 RM’000

Primary agriculture 12,410 83,227

Manufacturing 481,896 488,919

Transport, storage and communication 730,175 639,331

Construction 737,309 775,478

Wholesale and retail trade, and restaurants and hotels 226,573 328,094

Others 194,114 328,568

2,382,477 2,643,617

(ix) Movements in the allowance for ECL for loans, advances and financing are as follows:

Stage 1 Stage 2 Stage 3

Lifetime ECL Lifetime

12-months not credit ECL credit

ECL impaired impaired Total ECL

RM’000 RM’000 RM’000 RM’000

Group and Bank

2020

At 1 January 83,810 190,300 1,968,281 2,242,391

Transferred from Stage 1 (244) - 244 -

Transferred from Stage 2 (89) 89 - -

Transferred to Stage 3 - (65,561) 65,561 -

(Written back)/allowance recognised in profit and loss 5,477 (6,252) (187,816) (188,591)

Financial assets derecognised (11,984) (140) - (12,124)

Changes due to change in credit risk (10,769) 102,835 - 92,066

Modification to contractual cash flows of financial assets (34,632) 196,924 - 162,292

Total amount charged to profit and loss during the period (52,241) 227,895 (122,011) 53,643

Other movement with no profit and loss impact

Write offs - - (220,073) (220,073)

Exchange differences - - (15,480) (15,480)

At 31 December 31,569 418,195 1,610,717 2,060,481