Page 128 - EXIM-BANK-AR20

P. 128

126 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

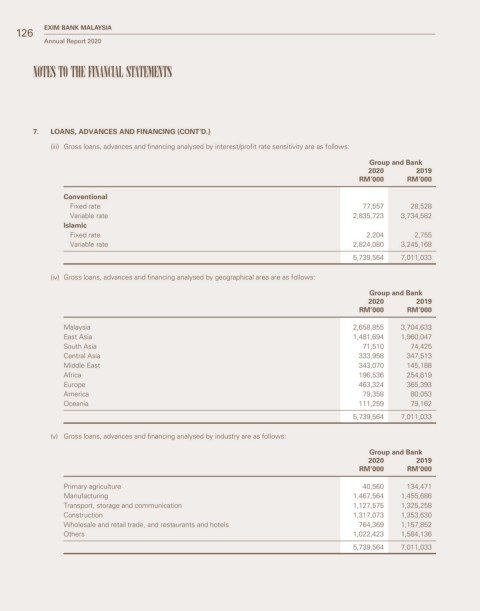

7. LOANS, ADVANCES AND FINANCING (CONT’D.)

(iii) Gross loans, advances and financing analysed by interest/profit rate sensitivity are as follows:

Group and Bank

2020 2019

RM’000 RM’000

Conventional

Fixed rate 77,557 28,528

Variable rate 2,835,723 3,734,582

Islamic

Fixed rate 2,204 2,755

Variable rate 2,824,080 3,245,168

5,739,564 7,011,033

(iv) Gross loans, advances and financing analysed by geographical area are as follows:

Group and Bank

2020 2019

RM’000 RM’000

Malaysia 2,658,855 3,704,633

East Asia 1,481,694 1,960,047

South Asia 71,510 74,425

Central Asia 333,958 347,513

Middle East 343,070 145,188

Africa 196,536 254,619

Europe 463,324 365,393

America 79,358 80,053

Oceania 111,259 79,162

5,739,564 7,011,033

(v) Gross loans, advances and financing analysed by industry are as follows:

Group and Bank

2020 2019

RM’000 RM’000

Primary agriculture 40,560 134,471

Manufacturing 1,467,564 1,455,686

Transport, storage and communication 1,127,575 1,325,258

Construction 1,317,073 1,353,630

Wholesale and retail trade, and restaurants and hotels 764,369 1,157,852

Others 1,022,423 1,584,136

5,739,564 7,011,033