Page 124 - EXIM-BANK-AR20

P. 124

122 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

3. SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENT (CONT’D.)

3.3 Basis for expected credit losses (“ECL”) management overlays due to COVID-19

With the recent and rapid development of the coronavirus outbreak in Malaysia, the Government of Malaysia had initially

declared a Movement Control Order (“MCO”) from 18 March 2020 to 14 April 2020. This was then extended through

the Conditional MCO and Recovery MCO throughout 2020.

The MCO involved limitation and/or suspension of business operations, travel restrictions, and quarantine measures.

Similar measures have also been introduced in various countries, some of which the Group and the Bank have exposure

in. Whilst these measures may not have an immediate and pronounced impact on the banking industry, it is expected

to have some effect, impacting, for example the Group’s and the Bank’s allowance for ECL on loans, advances and

financing, liabilities in respect of certain insurance/Takaful products and the valuation of financial investments.

As the outbreak continues to progress and evolve, it is challenging at this juncture, to predict the full extent and duration

of its business and economic impact. The Group and the Bank will continue to monitor the progress of the outbreak

and measure and report the impact, if any, of the outbreak on their financial statements as they occur subsequent to

the reporting date. As the current MFRS 9 models may not fully reflect the ECL impact arising from the unprecedented

ongoing COVID-19 pandemic, management overlays have been applied to determine a sufficient overall level of

ECL for the financial year ended 31 December 2020. The management overlay on ECL for financial investment and

loans, advances and financing for the Group and the Bank as at 31 December 2020 are RM54,259,225 (2019: Nil) and

RM150,431,032 (2019: Nil) respectively.

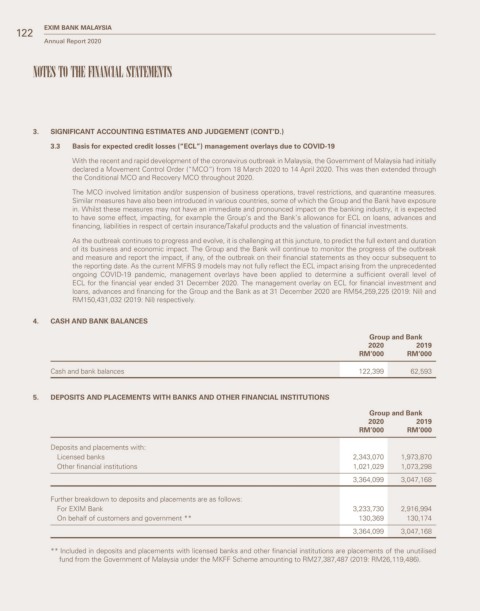

4. CASH AND BANK BALANCES

Group and Bank

2020 2019

RM’000 RM’000

Cash and bank balances 122,399 62,593

5. DEPOSITS AND PLACEMENTS WITH BANKS AND OTHER FINANCIAL INSTITUTIONS

Group and Bank

2020 2019

RM’000 RM’000

Deposits and placements with:

Licensed banks 2,343,070 1,973,870

Other financial institutions 1,021,029 1,073,298

3,364,099 3,047,168

Further breakdown to deposits and placements are as follows:

For EXIM Bank 3,233,730 2,916,994

On behalf of customers and government ** 130,369 130,174

3,364,099 3,047,168

** Included in deposits and placements with licensed banks and other financial institutions are placements of the unutilised

fund from the Government of Malaysia under the MKFF Scheme amounting to RM27,387,487 (2019: RM26,119,486).