Page 126 - EXIM-BANK-AR20

P. 126

124 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

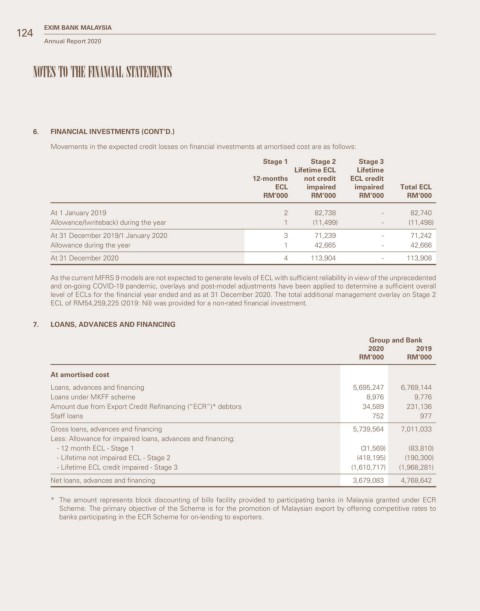

6. FINANCIAL INVESTMENTS (CONT’D.)

Movements in the expected credit losses on financial investments at amortised cost are as follows:

Stage 1 Stage 2 Stage 3

Lifetime ECL Lifetime

12-months not credit ECL credit

ECL impaired impaired Total ECL

RM’000 RM’000 RM’000 RM’000

At 1 January 2019 2 82,738 - 82,740

Allowance/(writeback) during the year 1 (11,499) - (11,498)

At 31 December 2019/1 January 2020 3 71,239 - 71,242

Allowance during the year 1 42,665 - 42,666

At 31 December 2020 4 113,904 - 113,908

As the current MFRS 9 models are not expected to generate levels of ECL with sufficient reliability in view of the unprecedented

and on-going COVID-19 pandemic, overlays and post-model adjustments have been applied to determine a sufficient overall

level of ECLs for the financial year ended and as at 31 December 2020. The total additional management overlay on Stage 2

ECL of RM54,259,225 (2019: Nil) was provided for a non-rated financial investment.

7. LOANS, ADVANCES AND FINANCING

Group and Bank

2020 2019

RM’000 RM’000

At amortised cost

Loans, advances and financing 5,695,247 6,769,144

Loans under MKFF scheme 8,976 9,776

Amount due from Export Credit Refinancing (“ECR”)* debtors 34,589 231,136

Staff loans 752 977

Gross loans, advances and financing 5,739,564 7,011,033

Less: Allowance for impaired loans, advances and financing:

- 12 month ECL - Stage 1 (31,569) (83,810)

- Lifetime not impaired ECL - Stage 2 (418,195) (190,300)

- Lifetime ECL credit impaired - Stage 3 (1,610,717) (1,968,281)

Net loans, advances and financing 3,679,083 4,768,642

* The amount represents block discounting of bills facility provided to participating banks in Malaysia granted under ECR

Scheme. The primary objective of the Scheme is for the promotion of Malaysian export by offering competitive rates to

banks participating in the ECR Scheme for on-lending to exporters.