Page 136 - EXIM_AR2021

P. 136

134 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

7. lOans, aDvances anD financing (cOnt’D.)

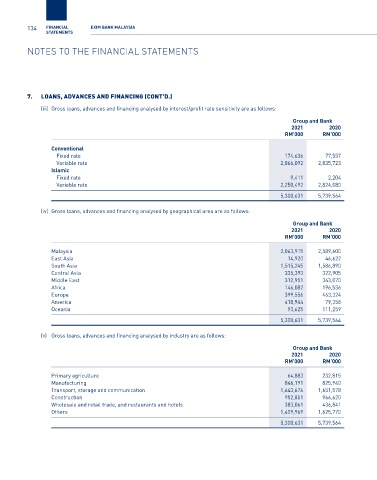

(iii) Gross loans, advances and financing analysed by interest/profit rate sensitivity are as follows:

Group and Bank

2021 2020

RM’000 RM’000

Conventional

Fixed rate 174,636 77,557

Variable rate 2,866,092 2,835,723

Islamic

Fixed rate 9,411 2,204

Variable rate 2,250,492 2,824,080

5,300,631 5,739,564

(iv) Gross loans, advances and financing analysed by geographical area are as follows:

Group and Bank

2021 2020

RM’000 RM’000

Malaysia 2,063,915 2,589,600

East Asia 14,920 46,622

South Asia 1,515,245 1,586,890

Central Asia 335,393 322,905

Middle East 312,951 343,070

Africa 146,082 196,536

Europe 399,556 463,324

America 418,944 79,358

Oceania 93,625 111,259

5,300,631 5,739,564

(v) Gross loans, advances and financing analysed by industry are as follows:

Group and Bank

2021 2020

RM’000 RM’000

Primary agriculture 64,883 232,815

Manufacturing 846,191 825,940

Transport, storage and communication 1,643,676 1,651,578

Construction 952,851 966,620

Wholesale and retail trade, and restaurants and hotels 383,061 436,841

Others 1,409,969 1,625,770

5,300,631 5,739,564