Page 145 - EXIM_AR2021

P. 145

ANNUAL REPORT 2021 143

Notes to the fiNaNcial statemeNts

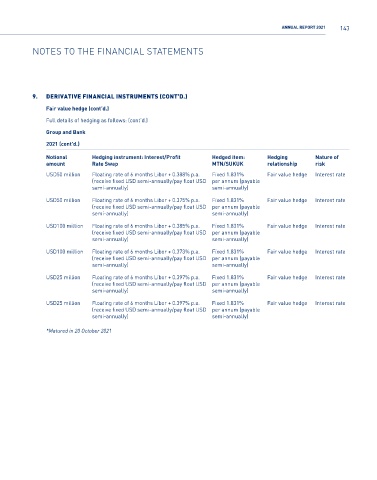

9. Derivative financial instrUments (cOnt’D.)

Fair value hedge (cont’d.)

Full details of hedging as follows: (cont’d.)

Group and Bank

2021 (cont’d.)

Notional hedging instrument: Interest/Profit hedged item: hedging Nature of

amount Rate Swap MTN/SUKUK relationship risk

USD50 million Floating rate of 6 months Libor + 0.388% p.a. Fixed 1.831% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

semi-annually) semi-annually)

USD50 million Floating rate of 6 months Libor + 0.375% p.a. Fixed 1.831% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

semi-annually) semi-annually)

USD100 million Floating rate of 6 months Libor + 0.385% p.a. Fixed 1.831% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

semi-annually) semi-annually)

USD100 million Floating rate of 6 months Libor + 0.373% p.a. Fixed 1.831% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

semi-annually) semi-annually)

USD25 million Floating rate of 6 months Libor + 0.397% p.a. Fixed 1.831% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

semi-annually) semi-annually)

USD25 million Floating rate of 6 months Libor + 0.397% p.a. Fixed 1.831% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

semi-annually) semi-annually)

*Matured in 20 October 2021