Page 149 - EXIM_AR2021

P. 149

ANNUAL REPORT 2021 147

Notes to the fiNaNcial statemeNts

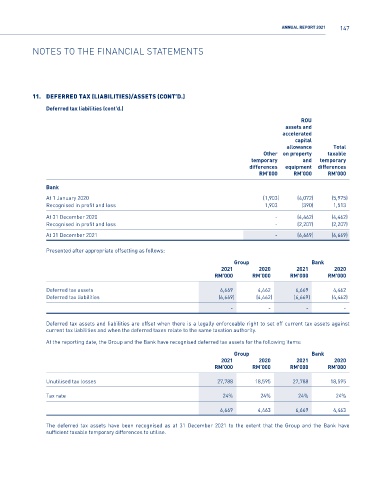

11. DeferreD tax (liabilities)/assets (cOnt’D.)

Deferred tax liabilities (cont’d.)

ROU

assets and

accelerated

capital

allowance Total

Other on property taxable

temporary and temporary

differences equipment differences

RM’000 RM’000 RM’000

Bank

At 1 January 2020 (1,903) (4,072) (5,975)

Recognised in profit and loss 1,903 (390) 1,513

At 31 December 2020 - (4,462) (4,462)

Recognised in profit and loss - (2,207) (2,207)

At 31 December 2021 - (6,669) (6,669)

Presented after appropriate offsetting as follows:

Group Bank

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Deferred tax assets 6,669 4,462 6,669 4,462

Deferred tax liabilities (6,669) (4,462) (6,669) (4,462)

- - - -

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against

current tax liabilities and when the deferred taxes relate to the same taxation authority.

At the reporting date, the Group and the Bank have recognised deferred tax assets for the following items:

Group Bank

2021 2020 2021 2020

RM’000 RM’000 RM’000 RM’000

Unutilised tax losses 27,788 18,595 27,788 18,595

Tax rate 24% 24% 24% 24%

6,669 4,463 6,669 4,463

The deferred tax assets have been recognised as at 31 December 2021 to the extent that the Group and the Bank have

sufficient taxable temporary differences to utilise.