Page 148 - EXIM_AR2021

P. 148

146 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

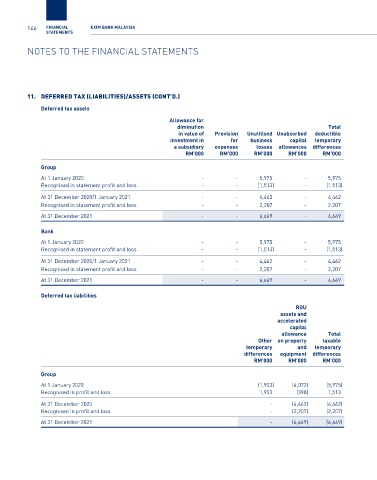

11. DeferreD tax (liabilities)/assets (cOnt’D.)

Deferred tax assets

Allowance for

diminution Total

in value of Provision Unutilised Unabsorbed deductible

investment in for business capital temporary

a subsidiary expenses losses allowances differences

RM’000 RM’000 RM’000 RM’000 RM’000

Group

At 1 January 2020 - - 5,975 - 5,975

Recognised in statement profit and loss - - (1,513) - (1,513)

At 31 December 2020/1 January 2021 - - 4,462 - 4,462

Recognised in statement profit and loss - - 2,207 - 2,207

At 31 December 2021 - - 6,669 - 6,669

Bank

At 1 January 2020 - - 5,975 - 5,975

Recognised in statement profit and loss - - (1,513) - (1,513)

At 31 December 2020/1 January 2021 - - 4,462 - 4,462

Recognised in statement profit and loss - - 2,207 - 2,207

At 31 December 2021 - - 6,669 - 6,669

Deferred tax liabilities

ROU

assets and

accelerated

capital

allowance Total

Other on property taxable

temporary and temporary

differences equipment differences

RM’000 RM’000 RM’000

Group

At 1 January 2020 (1,903) (4,072) (5,975)

Recognised in profit and loss 1,903 (390) 1,513

At 31 December 2020 - (4,462) (4,462)

Recognised in profit and loss - (2,207) (2,207)

At 31 December 2021 - (6,669) (6,669)