Page 146 - EXIM_AR2021

P. 146

144 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

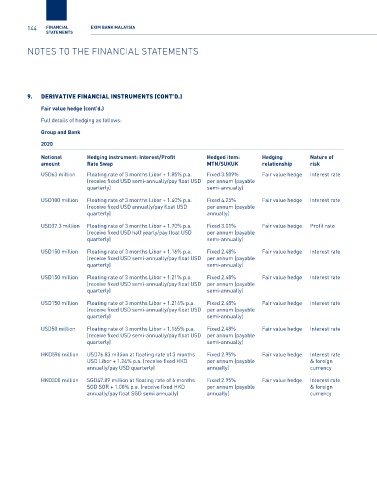

9. Derivative financial instrUments (cOnt’D.)

Fair value hedge (cont’d.)

Full details of hedging as follows:

Group and Bank

2020

Notional hedging instrument: Interest/Profit hedged item: hedging Nature of

amount Rate Swap MTN/SUKUK relationship risk

USD63 million Floating rate of 3 months Libor + 1.85% p.a. Fixed 3.509% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

USD100 million Floating rate of 3 months Libor + 1.40% p.a. Fixed 4.25% Fair value hedge Interest rate

(receive fixed USD annually/pay float USD per annum (payable

quarterly) annually)

USD37.3 million Floating rate of 3 months Libor + 1.70% p.a. Fixed 3.01% Fair value hedge Profit rate

(receive fixed USD half yearly/pay float USD per annum (payable

quarterly) semi-annually)

USD150 million Floating rate of 3 months Libor + 1.16% p.a. Fixed 2.48% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

USD150 million Floating rate of 3 months Libor + 1.21% p.a. Fixed 2.48% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

USD150 million Floating rate of 3 months Libor + 1.214% p.a. Fixed 2.48% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

USD50 million Floating rate of 3 months Libor + 1.165% p.a. Fixed 2.48% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

HKD596 million USD76.83 million at floating rate of 3 months Fixed 2.95% Fair value hedge Interest rate

USD Libor + 1.24% p.a. (receive fixed HKD per annum (payable & foreign

annually/pay USD quarterly) annually) currency

HKD300 million SGD47.89 million at floating rate of 6 months Fixed 2.95% Fair value hedge Interest rate

SGD SOR + 1.00% p.a. (receive fixed HKD per annum (payable & foreign

annually/pay float SGD semi annually) annually) currency