Page 164 - EXIM_AR2021

P. 164

162 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

23. share caPital anD reDeemable cOnvertible cUmUlative Preference shares

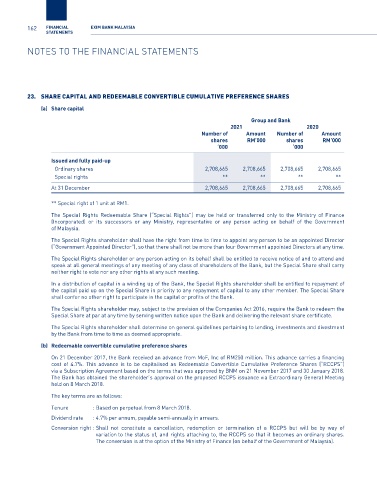

(a) Share capital

Group and Bank

2021 2020

Number of Amount Number of Amount

shares RM’000 shares RM’000

‘000 ‘000

Issued and fully paid-up

Ordinary shares 2,708,665 2,708,665 2,708,665 2,708,665

Special rights ** ** ** **

At 31 December 2,708,665 2,708,665 2,708,665 2,708,665

** Special right of 1 unit at RM1.

The Special Rights Redeemable Share (“Special Rights”) may be held or transferred only to the Ministry of Finance

(Incorporated) or its successors or any Ministry, representative or any person acting on behalf of the Government

of Malaysia.

The Special Rights shareholder shall have the right from time to time to appoint any person to be an appointed Director

(“Government Appointed Director”), so that there shall not be more than four Government appointed Directors at any time.

The Special Rights shareholder or any person acting on its behalf shall be entitled to receive notice of and to attend and

speak at all general meetings of any meeting of any class of shareholders of the Bank, but the Special Share shall carry

neither right to vote nor any other rights at any such meeting.

In a distribution of capital in a winding up of the Bank, the Special Rights shareholder shall be entitled to repayment of

the capital paid up on the Special Share in priority to any repayment of capital to any other member. The Special Share

shall confer no other right to participate in the capital or profits of the Bank.

The Special Rights shareholder may, subject to the provision of the Companies Act 2016, require the Bank to redeem the

Special Share at par at any time by serving written notice upon the Bank and delivering the relevant share certificate.

The Special Rights shareholder shall determine on general guidelines pertaining to lending, investments and divestment

by the Bank from time to time as deemed appropriate.

(b) Redeemable convertible cumulative preference shares

On 21 December 2017, the Bank received an advance from MoF, Inc of RM250 million. This advance carries a financing

cost of 4.7%. This advance is to be capitalised as Redeemable Convertible Cumulative Preference Shares (“RCCPS”)

via a Subscription Agreement based on the terms that was approved by BNM on 21 November 2017 and 30 January 2018.

The Bank has obtained the shareholder’s approval on the proposed RCCPS issuance via Extraordinary General Meeting

held on 8 March 2018.

The key terms are as follows:

Tenure : Based on perpetual from 8 March 2018.

Dividend rate : 4.7% per annum, payable semi-annually in arrears.

Conversion right : Shall not constitute a cancellation, redemption or termination of a RCCPS but will be by way of

variation to the status of, and rights attaching to, the RCCPS so that it becomes an ordinary shares.

The conversion is at the option of the Ministry of Finance (on behalf of the Government of Malaysia).