Page 159 - EXIM_AR2021

P. 159

ANNUAL REPORT 2021 157

Notes to the fiNaNcial statemeNts

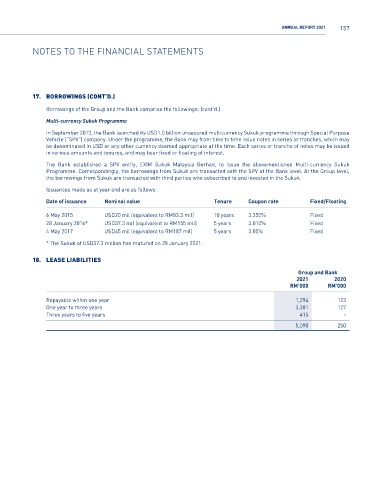

17. bOrrOwings (cOnt’D.)

Borrowings of the Group and the Bank comprise the followings: (cont’d.)

Multi-currency Sukuk Programme

In September 2013, the Bank launched its USD1.0 billion unsecured multicurrency Sukuk programme through Special Purpose

Vehicle (“SPV”) company. Under the programme, the Bank may from time to time issue notes in series or tranches, which may

be denominated in USD or any other currency deemed appropriate at the time. Each series or tranche of notes may be issued

in various amounts and tenures, and may bear fixed or floating of interest.

The Bank established a SPV entity, EXIM Sukuk Malaysia Berhad, to issue the abovementioned Multi-currency Sukuk

Programme. Correspondingly, the borrowings from Sukuk are transacted with the SPV at the Bank level. At the Group level,

the borrowings from Sukuk are transacted with third parties who subscribed to and invested in the Sukuk.

Issuances made as at year end are as follows:

Date of issuance Nominal value Tenure Coupon rate Fixed/Floating

6 May 2015 USD20 mil (equivalent to RM83.3 mil) 10 years 3.350% Fixed

28 January 2016* USD37.3 mil (equivalent to RM155 mil) 5 years 3.010% Fixed

4 May 2017 USD45 mil (equivalent to RM187 mil) 5 years 3.00% Fixed

* The Sukuk of USD37.3 million has matured on 28 January 2021.

18. lease liabilities

Group and Bank

2021 2020

RM’000 RM’000

Repayable within one year 1,294 123

One year to three years 3,381 127

Three years to five years 415 -

5,090 250