Page 156 - EXIM_AR2021

P. 156

154 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

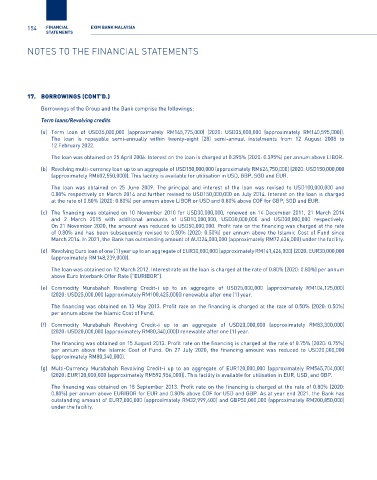

17. bOrrOwings (cOnt’D.)

Borrowings of the Group and the Bank comprise the followings:

Term loans/Revolving credits

(a) Term loan of USD35,000,000 (approximately RM145,775,000) (2020: USD35,000,000 (approximately RM140,595,000)).

The loan is repayable semi-annually within twenty-eight (28) semi-annual instalments from 12 August 2008 to

12 February 2022.

The loan was obtained on 25 April 2006. Interest on the loan is charged at 0.395% (2020: 0.395%) per annum above LIBOR.

(b) Revolving multi-currency loan up to an aggregate of USD150,000,000 (approximately RM624,750,000) (2020: USD150,000,000

(approximately RM602,550,000)). This facility is available for utilisation in USD, GBP, SGD and EUR.

The loan was obtained on 25 June 2009. The principal and interest of the loan was revised to USD100,000,000 and

0.80% respectively on March 2014 and further revised to USD150,000,000 on July 2014. Interest on the loan is charged

at the rate of 0.80% (2020: 0.80%) per annum above LIBOR or USD and 0.80% above COF for GBP, SGD and EUR.

(c) The financing was obtained on 10 November 2010 for USD30,000,000, renewed on 14 December 2011, 21 March 2014

and 2 March 2015 with additional amounts of USD10,000,000, USD30,000,000 and USD30,000,000 respectively.

On 21 November 2020, the amount was reduced to USD50,000,000. Profit rate on the financing was charged at the rate

of 0.80% and has been subsequently revised to 0.50% (2020: 0.50%) per annum above the Islamic Cost of Fund since

March 2014. In 2021, the Bank has outstanding amount of AUD24,000,000 (approximately RM72,636,000) under the facility.

(d) Revolving Euro loan of one (1) year up to an aggregate of EUR30,000,000 (approximately RM141,426,000) (2020: EUR30,000,000

(approximately RM148,239,000)).

The loan was obtained on 12 March 2012. Interest rate on the loan is charged at the rate of 0.80% (2020: 0.80%) per annum

above Euro Interbank Offer Rate (“EURIBOR”).

(e) Commodity Murabahah Revolving Credit-i up to an aggregate of USD25,000,000 (approximately RM104,125,000)

(2020: USD25,000,000 (approximately RM100,425,000)) renewable after one (1) year.

The financing was obtained on 13 May 2013. Profit rate on the financing is charged at the rate of 0.50% (2020: 0.50%)

per annum above the Islamic Cost of Fund.

(f) Commodity Murabahah Revolving Credit-i up to an aggregate of USD20,000,000 (approximately RM83,300,000)

(2020: USD20,000,000 (approximately RM80,340,000)) renewable after one (1) year.

The financing was obtained on 15 August 2013. Profit rate on the financing is charged at the rate of 0.75% (2020: 0.75%)

per annum above the Islamic Cost of Fund. On 27 July 2020, the financing amount was reduced to USD20,000,000

(approximately RM80,340,000).

(g) Multi-Currency Murabahah Revolving Credit-i up to an aggregate of EUR120,000,000 (approximately RM565,704,000)

(2020: EUR120,000,000 (approximately RM592,956,000)). This facility is available for utilisation in EUR, USD, and GBP.

The financing was obtained on 18 September 2013. Profit rate on the financing is charged at the rate of 0.80% (2020:

0.80%) per annum above EURIBOR for EUR and 0.80% above COF for USD and GBP. As at year end 2021, the Bank has

outstanding amount of EUR7,000,000 (approximately RM32,999,400) and GBP50,000,000 (approximately RM200,850,000)

under the facility.