Page 157 - EXIM_AR2021

P. 157

ANNUAL REPORT 2021 155

Notes to the fiNaNcial statemeNts

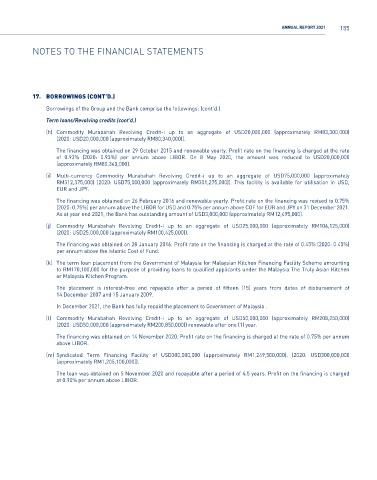

17. bOrrOwings (cOnt’D.)

Borrowings of the Group and the Bank comprise the followings: (cont’d.)

Term loans/Revolving credits (cont’d.)

(h) Commodity Murabahah Revolving Credit-i up to an aggregate of USD20,000,000 (approximately RM83,300,000)

(2020: USD20,000,000 (approximately RM80,340,000)).

The financing was obtained on 29 October 2015 and renewable yearly. Profit rate on the financing is charged at the rate

of 0.93% (2020: 0.93%) per annum above LIBOR. On 8 May 2020, the amount was reduced to USD20,000,000

(approximately RM80,340,000).

(i) Multi-currency Commodity Murabahah Revolving Credit-i up to an aggregate of USD75,000,000 (approximately

RM312,375,000) (2020: USD75,000,000 (approximately RM301,275,000)). This facility is available for utilisation in USD,

EUR and JPY.

The financing was obtained on 26 February 2016 and renewable yearly. Profit rate on the financing was revised to 0.75%

(2020: 0.75%) per annum above the LIBOR for USD and 0.75% per annum above COF for EUR and JPY on 31 December 2021.

As at year end 2021, the Bank has outstanding amount of USD3,000,000 (approximately RM12,495,000).

(j) Commodity Murabahah Revolving Credit-i up to an aggregate of USD25,000,000 (approximately RM104,125,000)

(2020: USD25,000,000 (approximately RM100,425,000)).

The financing was obtained on 28 January 2016. Profit rate on the financing is charged at the rate of 0.45% (2020: 0.45%)

per annum above the Islamic Cost of Fund.

(k) The term loan placement from the Government of Malaysia for Malaysian Kitchen Financing Facility Scheme amounting

to RM170,100,000 for the purpose of providing loans to qualified applicants under the Malaysia The Truly Asian Kitchen

or Malaysia Kitchen Program.

The placement is interest-free and repayable after a period of fifteen (15) years from dates of disbursement of

14 December 2007 and 15 January 2009.

In December 2021, the Bank has fully repaid the placement to Government of Malaysia .

(l) Commodity Murabahah Revolving Credit-i up to an aggregate of USD50,000,000 (approximately RM208,250,000)

(2020: USD50,000,000 (approximately RM200,850,000)) renewable after one (1) year.

The financing was obtained on 14 November 2020. Profit rate on the financing is charged at the rate of 0.75% per annum

above LIBOR.

(m) Syndicated Term Financing Facility of USD300,000,000 (approximately RM1,249,500,000). (2020: USD300,000,000

(approximately RM1,205,100,000)).

The loan was obtained on 5 November 2020 and repayable after a period of 4.5 years. Profit on the financing is charged

at 0.90% per annum above LIBOR.