Page 136 - EXIM-Bank_Annual-Report-2022

P. 136

134 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

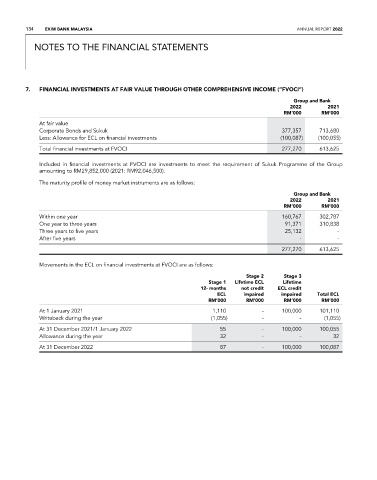

7. FINaNCIaL INVESTMENTS aT FaIR VaLUE THROUGH OTHER COMPREHENSIVE INCOME (“FVOCI”)

Group and Bank

2022 2021

rM’000 rM’000

At fair value

Corporate Bonds and Sukuk 377,357 713,680

Less: Allowance for ECL on financial investments (100,087) (100,055)

Total financial investments at FVOCI 277,270 613,625

Included in financial investments at FVOCI are investments to meet the requirement of Sukuk Programme of the Group

amounting to RM29,852,000 (2021: RM92,046,500).

The maturity profile of money market instruments are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Within one year 160,767 302,787

One year to three years 91,371 310,838

Three years to five years 25,132 -

After five years - -

277,270 613,625

Movements in the ECL on financial investments at FVOCI are as follows:

stage 2 stage 3

stage 1 Lifetime eCL Lifetime

12- months not credit eCL credit

eCL impaired impaired total eCL

rM’000 rM’000 rM’000 rM’000

At 1 January 2021 1,110 - 100,000 101,110

Writeback during the year (1,055) - - (1,055)

At 31 December 2021/1 January 2022 55 - 100,000 100,055

Allowance during the year 32 - - 32

At 31 December 2022 87 - 100,000 100,087