Page 140 - EXIM-Bank_Annual-Report-2022

P. 140

138 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

9. LoANs, ADvANCes AND FINANCING (cont’d.)

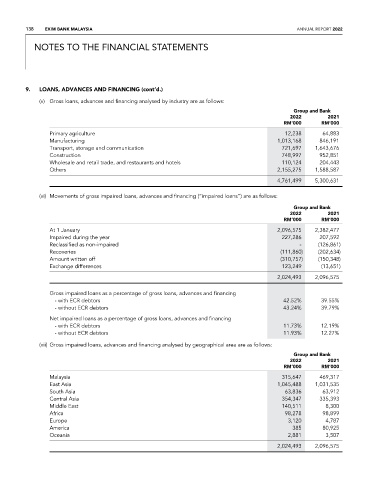

(v) Gross loans, advances and financing analysed by industry are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Primary agriculture 12,238 64,883

Manufacturing 1,013,168 846,191

Transport, storage and communication 721,697 1,643,676

Construction 748,997 952,851

Wholesale and retail trade, and restaurants and hotels 110,124 204,443

Others 2,155,275 1,588,587

4,761,499 5,300,631

(vi) Movements of gross impaired loans, advances and financing (“impaired loans”) are as follows:

Group and Bank

2022 2021

rM’000 rM’000

At 1 January 2,096,575 2,382,477

Impaired during the year 227,286 207,592

Reclassified as non-impaired - (126,861)

Recoveries (111,860) (202,634)

Amount written off (310,757) (150,348)

Exchange differences 123,249 (13,651)

2,024,493 2,096,575

Gross impaired loans as a percentage of gross loans, advances and financing

- with ECR debtors 42.52% 39.55%

- without ECR debtors 43.24% 39.79%

Net impaired loans as a percentage of gross loans, advances and financing

- with ECR debtors 11.73% 12.19%

- without ECR debtors 11.93% 12.27%

(vii) Gross impaired loans, advances and financing analysed by geographical area are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Malaysia 315,647 469,317

East Asia 1,045,488 1,031,535

South Asia 63,836 63,912

Central Asia 354,347 335,393

Middle East 140,511 8,300

Africa 98,278 98,899

Europe 3,120 4,787

America 385 80,925

Oceania 2,881 3,507

2,024,493 2,096,575