Page 139 - EXIM-Bank_Annual-Report-2022

P. 139

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 137

Notes to the fiNaNcial statemeNts

9. LoANs, ADvANCes AND FINANCING (cont’d.)

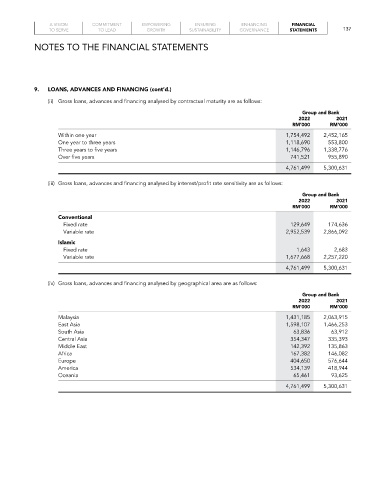

(ii) Gross loans, advances and financing analysed by contractual maturity are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Within one year 1,754,492 2,452,165

One year to three years 1,118,690 553,800

Three years to five years 1,146,796 1,338,776

Over five years 741,521 955,890

4,761,499 5,300,631

(iii) Gross loans, advances and financing analysed by interest/profit rate sensitivity are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Conventional

Fixed rate 129,649 174,636

Variable rate 2,952,539 2,866,092

Islamic

Fixed rate 1,643 2,683

Variable rate 1,677,668 2,257,220

4,761,499 5,300,631

(iv) Gross loans, advances and financing analysed by geographical area are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Malaysia 1,431,185 2,063,915

East Asia 1,598,107 1,466,253

South Asia 63,836 63,912

Central Asia 354,347 335,393

Middle East 142,392 135,863

Africa 167,382 146,082

Europe 404,650 576,644

America 534,139 418,944

Oceania 65,461 93,625

4,761,499 5,300,631