Page 141 - EXIM-Bank_Annual-Report-2022

P. 141

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 139

Notes to the fiNaNcial statemeNts

9. LoANs, ADvANCes AND FINANCING (cont’d.)

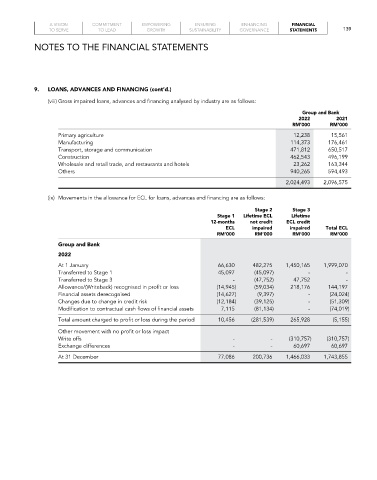

(viii) Gross impaired loans, advances and financing analysed by industry are as follows:

Group and Bank

2022 2021

rM’000 rM’000

Primary agriculture 12,238 15,561

Manufacturing 114,373 176,461

Transport, storage and communication 471,812 650,517

Construction 462,543 496,199

Wholesale and retail trade, and restaurants and hotels 23,262 163,344

Others 940,265 594,493

2,024,493 2,096,575

(ix) Movements in the allowance for ECL for loans, advances and financing are as follows:

stage 2 stage 3

stage 1 Lifetime eCL Lifetime

12-months not credit eCL credit

eCL impaired impaired total eCL

rM’000 rM’000 rM’000 rM’000

Group and Bank

2022

At 1 January 66,630 482,275 1,450,165 1,999,070

Transferred to Stage 1 45,097 (45,097) - -

Transferred to Stage 3 - (47,752) 47,752 -

Allowance/(Writeback) recognised in profit or loss (14,945) (59,034) 218,176 144,197

Financial assets derecognised (14,627) (9,397) - (24,024)

Changes due to change in credit risk (12,184) (39,125) - (51,309)

Modification to contractual cash flows of financial assets 7,115 (81,134) - (74,019)

Total amount charged to profit or loss during the period 10,456 (281,539) 265,928 (5,155)

Other movement with no profit or loss impact

Write offs - - (310,757) (310,757)

Exchange differences - - 60,697 60,697

At 31 December 77,086 200,736 1,466,033 1,743,855