Page 195 - EXIM-Bank_Annual-Report-2022

P. 195

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 193

Notes to the fiNaNcial statemeNts

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

Credit risk management (cont’d.)

Impairment of financial assets

The Group and the Bank individually assesses its financial assets for any objective evidence of impairment as a result of one or

more loss events that occurred after the initial recognition. In determining that there is objective evidence of an impaired loss,

the Group and the Bank adopted a systematic mechanism for a prompt trigger of impairment test whereby the triggers are

based on obligatory and judgmental event triggers.

When there is objective evidence of impairment of the financial assets, the classification of these assets as impaired shall be

endorsed and approved by Management Committee (“MC”). Impairment losses are recorded as charges to the statement of

profit or loss. The carrying amount of impaired loans, advances and financing on the statement of financial position is reduced

through the use of impairment allowance account. Losses expected from future events are not recognised.

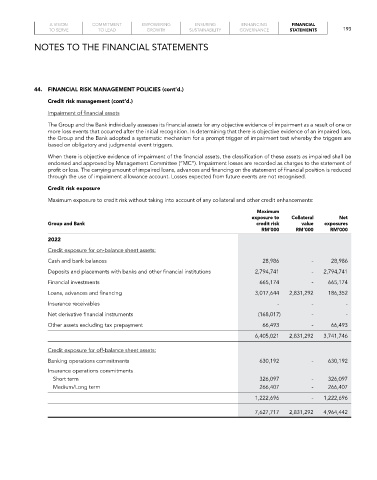

Credit risk exposure

Maximum exposure to credit risk without taking into account of any collateral and other credit enhancements:

Maximum

exposure to Collateral Net

Group and Bank credit risk value exposures

rM’000 rM’000 rM’000

2022

Credit exposure for on-balance sheet assets:

Cash and bank balances 28,986 - 28,986

Deposits and placements with banks and other financial institutions 2,794,741 - 2,794,741

Financial investments 665,174 - 665,174

Loans, advances and financing 3,017,644 2,831,292 186,352

Insurance receivables - - -

Net derivative financial instruments (168,017) - -

Other assets excluding tax prepayment 66,493 - 66,493

6,405,021 2,831,292 3,741,746

Credit exposure for off-balance sheet assets:

Banking operations commitments 630,192 - 630,192

Insurance operations commitments

Short term 326,097 - 326,097

Medium/Long term 266,407 - 266,407

1,222,696 - 1,222,696

7,627,717 2,831,292 4,964,442