Page 192 - EXIM-Bank_Annual-Report-2022

P. 192

190 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

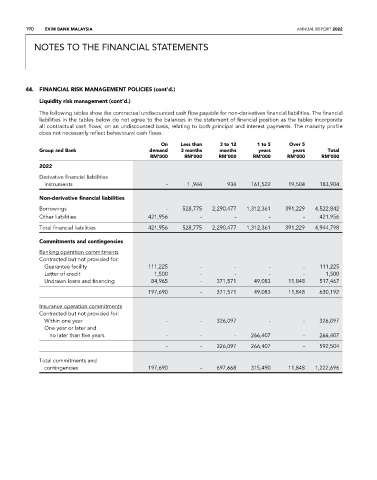

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

Liquidity risk management (cont’d.)

The following tables show the contractual undiscounted cash flow payable for non-derivatives financial liabilities. The financial

liabilities in the tables below do not agree to the balances in the statement of financial position as the tables incorporate

all contractual cash flows, on an undiscounted basis, relating to both principal and interest payments. The maturity profile

does not necessarily reflect behavioural cash flows.

On Less than 3 to 12 1 to 5 Over 5

Group and Bank demand 3 months months years years total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

2022

Derivative financial liabilities

instruments - 1 ,944 934 161,522 19,504 183,904

Non-derivative financial liabilities

Borrowings - 528,775 2,290,477 1,312,361 391,229 4,522,842

Other liabilities 421,956 - - - - 421,956

Total financial liabilities 421,956 528,775 2,290,477 1,312,361 391,229 4,944,798

Commitments and contingencies

Banking operation commitments

Contracted but not provided for:

Guarantee facility 111,225 - - - - 111,225

Letter of credit 1,500 - - - - 1,500

Undrawn loans and financing 84,965 - 371,571 49,083 11,848 517,467

197,690 - 371,571 49,083 11,848 630,192

Insurance operation commitments

Contracted but not provided for:

Within one year - - 326,097 - - 326,097

One year or later and

no later than five years - - - 266,407 - 266,407

- - 326,097 266,407 - 592,504

Total commitments and

contingencies 197,690 - 697,668 315,490 11,848 1,222,696