Page 188 - EXIM-Bank_Annual-Report-2022

P. 188

186 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

Liquidity risk management (cont’d.)

Measurement

Liquidity is measured by the Group’s and the Bank’s ability to efficiently and economically accommodate decrease in deposits/

funding (such as funds obtained from the Government) and other purchased liabilities and to fund increases in assets to ensure

continued growth of the Group and the Bank.

The Group and the Bank maintain large capital base, sufficient liquid assets, diversified funding sources, and regularly assesses

the long-standing relationship with traditional fund providers. These processes are subject to regular reviews to ensure

adequacy and appropriateness.

In addition, the Group’s and the Bank’s liquidity positions are monitored and managed through structural liquidity indicators,

such as loan to purchase funds and offshore revolving funds utilisation rate ratios to maintain an optimal funding mix and asset

composition.

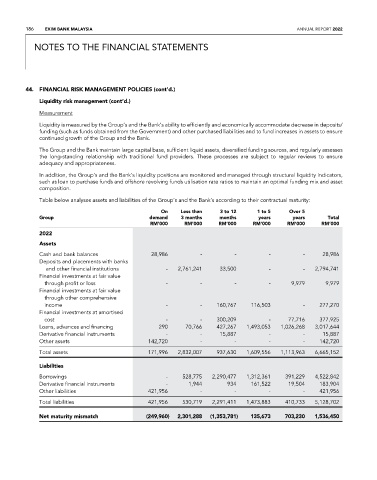

Table below analyses assets and liabilities of the Group’s and the Bank’s according to their contractual maturity:

On Less than 3 to 12 1 to 5 Over 5

Group demand 3 months months years years total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

2022

Assets

Cash and bank balances 28,986 - - - - 28,986

Deposits and placements with banks

and other financial institutions - 2,761,241 33,500 - - 2,794,741

Financial investments at fair value

through profit or loss - - - - 9,979 9,979

Financial investments at fair value

through other comprehensive

income - - 160,767 116,503 - 277,270

Financial investments at amortised

cost - - 300,209 - 77,716 377,925

Loans, advances and financing 290 70,766 427,267 1,493,053 1,026,268 3,017,644

Derivative financial instruments - - 15,887 - - 15,887

Other assets 142,720 - - - - 142,720

Total assets 171,996 2,832,007 937,630 1,609,556 1,113,963 6,665,152

Liabilities

Borrowings - 528,775 2,290,477 1,312,361 391,229 4,522,842

Derivative financial instruments - 1,944 934 161,522 19,504 183,904

Other liabilities 421,956 - - - - 421,956

Total liabilities 421,956 530,719 2,291,411 1,473,883 410,733 5,128,702

Net maturity mismatch (249,960) 2,301,288 (1,353,781) 135,673 703,230 1,536,450