Page 189 - EXIM-Bank_Annual-Report-2022

P. 189

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 187

Notes to the fiNaNcial statemeNts

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

Liquidity risk management (cont’d.)

Measurement (cont’d.)

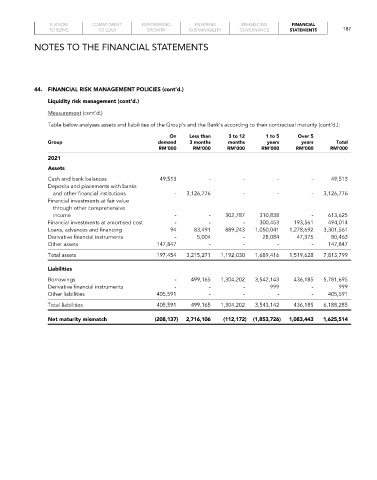

Table below analyses assets and liabilities of the Group’s and the Bank’s according to their contractual maturity (cont’d.):

On Less than 3 to 12 1 to 5 Over 5

Group demand 3 months months years years total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

2021

Assets

Cash and bank balances 49,513 - - - - 49,513

Deposits and placements with banks

and other financial institutions - 3,126,776 - - - 3,126,776

Financial investments at fair value

through other comprehensive

income - - 302,787 310,838 - 613,625

Financial investments at amortised cost - - - 300,453 193,561 494,014

Loans, advances and financing 94 83,491 889,243 1,050,041 1,278,692 3,301,561

Derivative financial instruments - 5,004 - 28,084 47,375 80,463

Other assets 147,847 - - - - 147,847

Total assets 197,454 3,215,271 1,192,030 1,689,416 1,519,628 7,813,799

Liabilities

Borrowings - 499,165 1,304,202 3,542,143 436,185 5,781,695

Derivative financial instruments - - - 999 - 999

Other liabilities 405,591 - - - - 405,591

Total liabilities 405,591 499,165 1,304,202 3,543,142 436,185 6,188,285

Net maturity mismatch (208,137) 2,716,106 (112,172) (1,853,726) 1,083,443 1,625,514