Page 63 - EXIM-BANK-AR20

P. 63

Section 05 Upholding Accountability

61

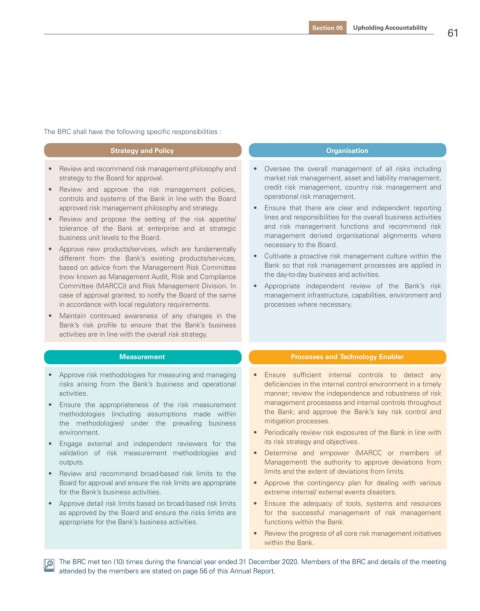

The BRC shall have the following specific responsibilities :

Strategy and Policy Organisation

• Review and recommend risk management philosophy and • Oversee the overall management of all risks including

strategy to the Board for approval. market risk management, asset and liability management,

• Review and approve the risk management policies, credit risk management, country risk management and

controls and systems of the Bank in line with the Board operational risk management.

approved risk management philosophy and strategy. • Ensure that there are clear and independent reporting

• Review and propose the setting of the risk appetite/ lines and responsibilities for the overall business activities

tolerance of the Bank at enterprise and at strategic and risk management functions and recommend risk

business unit levels to the Board. management derived organisational alignments where

necessary to the Board.

• Approve new products/services, which are fundamentally

different from the Bank’s existing products/services, • Cultivate a proactive risk management culture within the

based on advice from the Management Risk Committee Bank so that risk management processes are applied in

(now known as Management Audit, Risk and Compliance the day-to-day business and activities.

Committee (MARCC)) and Risk Management Division. In • Appropriate independent review of the Bank’s risk

case of approval granted, to notify the Board of the same management infrastructure, capabilities, environment and

in accordance with local regulatory requirements. processes where necessary.

• Maintain continued awareness of any changes in the

Bank’s risk profile to ensure that the Bank’s business

activities are in line with the overall risk strategy.

Measurement Processes and Technology Enabler

• Approve risk methodologies for measuring and managing • Ensure sufficient internal controls to detect any

risks arising from the Bank’s business and operational deficiencies in the internal control environment in a timely

activities. manner; review the independence and robustness of risk

• Ensure the appropriateness of the risk measurement management processess and internal controls throughout

methodologies (including assumptions made within the Bank; and approve the Bank’s key risk control and

the methodologies) under the prevailing business mitigation processes.

environment. • Periodically review risk exposures of the Bank in line with

• Engage external and independent reviewers for the its risk strategy and objectives.

validation of risk measurement methodologies and • Determine and empower (MARCC or members of

outputs. Management) the authority to approve deviations from

• Review and recommend broad-based risk limits to the limits and the extent of deviations from limits.

Board for approval and ensure the risk limits are appropriate • Approve the contingency plan for dealing with various

for the Bank’s business activities. extreme internal/ external events disasters.

• Approve detail risk limits based on broad-based risk limits • Ensure the adequacy of tools, systems and resources

as approved by the Board and ensure the risks limits are for the successful management of risk management

appropriate for the Bank’s business activities. functions within the Bank.

• Review the progress of all core risk management initiatives

within the Bank.

The BRC met ten (10) times during the financial year ended 31 December 2020. Members of the BRC and details of the meeting

attended by the members are stated on page 56 of this Annual Report.