Page 66 - EXIM-BANK-AR20

P. 66

64 EXIM BANK MALAYSIA

Annual Report 2020

SHARIAH GOVERNANCE

DISCLOSURE REPORT

1. OBJECTIVE

The Shariah Committee (SC) is responsible for ensuring that the Islamic banking and takaful business activities of EXIM Bank

are in compliance and conform to Shariah rules and principles.

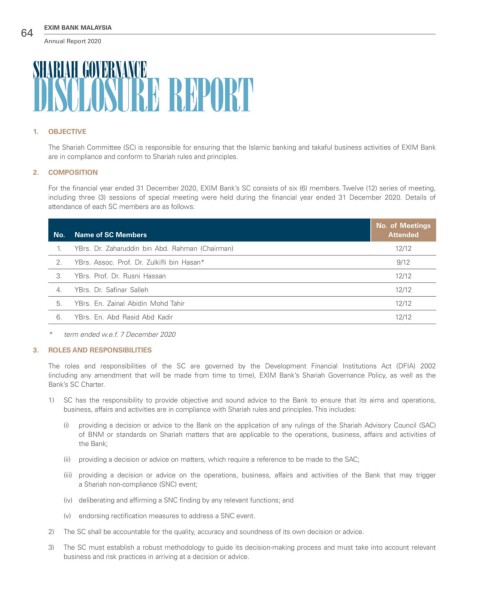

2. COMPOSITION

For the financial year ended 31 December 2020, EXIM Bank’s SC consists of six (6) members. Twelve (12) series of meeting,

including three (3) sessions of special meeting were held during the financial year ended 31 December 2020. Details of

attendance of each SC members are as follows:

No. of Meetings

No. Name of SC Members Attended

1. YBrs. Dr. Zaharuddin bin Abd. Rahman (Chairman) 12/12

2. YBrs. Assoc. Prof. Dr. Zulkifli bin Hasan* 9/12

3. YBrs. Prof. Dr. Rusni Hassan 12/12

4. YBrs. Dr. Safinar Salleh 12/12

5. YBrs. En. Zainal Abidin Mohd Tahir 12/12

6. YBrs. En. Abd Rasid Abd Kadir 12/12

* term ended w.e.f. 7 December 2020

3. ROLES AND RESPONSIBILITIES

The roles and responsibilities of the SC are governed by the Development Financial Institutions Act (DFIA) 2002

(including any amendment that will be made from time to time), EXIM Bank’s Shariah Governance Policy, as well as the

Bank’s SC Charter.

1) SC has the responsibility to provide objective and sound advice to the Bank to ensure that its aims and operations,

business, affairs and activities are in compliance with Shariah rules and principles. This includes:

(i) providing a decision or advice to the Bank on the application of any rulings of the Shariah Advisory Council (SAC)

of BNM or standards on Shariah matters that are applicable to the operations, business, affairs and activities of

the Bank;

(ii) providing a decision or advice on matters, which require a reference to be made to the SAC;

(iii) providing a decision or advice on the operations, business, affairs and activities of the Bank that may trigger

a Shariah non-compliance (SNC) event;

(iv) deliberating and affirming a SNC finding by any relevant functions; and

(v) endorsing rectification measures to address a SNC event.

2) The SC shall be accountable for the quality, accuracy and soundness of its own decision or advice.

3) The SC must establish a robust methodology to guide its decision-making process and must take into account relevant

business and risk practices in arriving at a decision or advice.