Page 61 - EXIM-BANK-AR20

P. 61

Section 05 Upholding Accountability

59

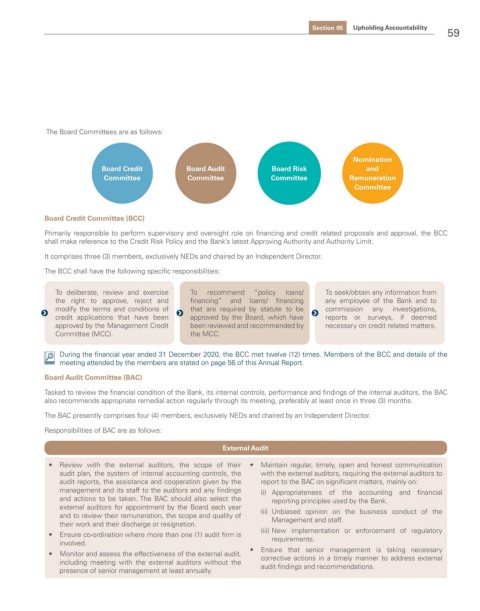

The Board Committees are as follows:

Nomination

Board Credit Board Audit Board Risk and

Committee Committee Committee Remuneration

Committee

Board Credit Committee (BCC)

Primarily responsible to perform supervisory and oversight role on financing and credit related proposals and approval, the BCC

shall make reference to the Credit Risk Policy and the Bank’s latest Approving Authority and Authority Limit.

It comprises three (3) members, exclusively NEDs and chaired by an Independent Director.

The BCC shall have the following specific responsibilities:

To deliberate, review and exercise To recommend “policy loans/ To seek/obtain any information from

the right to approve, reject and financing” and loans/ financing any employee of the Bank and to

modify the terms and conditions of that are required by statute to be commission any investigations,

credit applications that have been approved by the Board, which have reports or surveys, if deemed

approved by the Management Credit been reviewed and recommended by necessary on credit related matters.

Committee (MCC). the MCC.

During the financial year ended 31 December 2020, the BCC met twelve (12) times. Members of the BCC and details of the

meeting attended by the members are stated on page 56 of this Annual Report.

Board Audit Committee (BAC)

Tasked to review the financial condition of the Bank, its internal controls, performance and findings of the internal auditors, the BAC

also recommends appropriate remedial action regularly through its meeting, preferably at least once in three (3) months.

The BAC presently comprises four (4) members, exclusively NEDs and chaired by an Independent Director.

Responsibilities of BAC are as follows:

External Audit

• Review with the external auditors, the scope of their • Maintain regular, timely, open and honest communication

audit plan, the system of internal accounting controls, the with the external auditors, requiring the external auditors to

audit reports, the assistance and cooperation given by the report to the BAC on significant matters, mainly on:

management and its staff to the auditors and any findings (i) Appropriateness of the accounting and financial

and actions to be taken. The BAC should also select the reporting principles used by the Bank.

external auditors for appointment by the Board each year (ii) Unbiased opinion on the business conduct of the

and to review their remuneration, the scope and quality of Management and staff.

their work and their discharge or resignation.

• Ensure co-ordination where more than one (1) audit firm is (iii) New implementation or enforcement of regulatory

involved. requirements.

• Monitor and assess the effectiveness of the external audit, • Ensure that senior management is taking necessary

including meeting with the external auditors without the corrective actions in a timely manner to address external

presence of senior management at least annually. audit findings and recommendations.