Page 76 - EXIM-BANK-AR20

P. 76

74 EXIM BANK MALAYSIA

Annual Report 2020

STATEMENT OF RISK MANAGEMENT

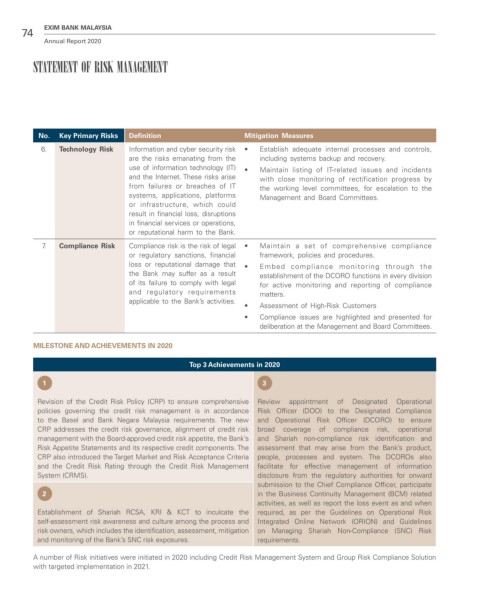

No. Key Primary Risks Definition Mitigation Measures

6. Technology Risk Information and cyber security risk • Establish adequate internal processes and controls,

are the risks emanating from the including systems backup and recovery.

use of information technology (IT) • Maintain listing of IT-related issues and incidents

and the Internet. These risks arise with close monitoring of rectification progress by

from failures or breaches of IT the working level committees, for escalation to the

systems, applications, platforms Management and Board Committees.

or infrastructure, which could

result in financial loss, disruptions

in financial services or operations,

or reputational harm to the Bank.

7. Compliance Risk Compliance risk is the risk of legal • Maintain a set of comprehensive compliance

or regulatory sanctions, financial framework, policies and procedures.

loss or reputational damage that • Embed compliance monitoring through the

the Bank may suffer as a result establishment of the DCORO functions in every division

of its failure to comply with legal for active monitoring and reporting of compliance

and regulatory requirements matters.

applicable to the Bank’s activities.

• Assessment of High-Risk Customers

• Compliance issues are highlighted and presented for

deliberation at the Management and Board Committees.

MILESTONE AND ACHIEVEMENTS IN 2020

Top 3 Achievements in 2020

1 3

Revision of the Credit Risk Policy (CRP) to ensure comprehensive Review appointment of Designated Operational

policies governing the credit risk management is in accordance Risk Officer (DOO) to the Designated Compliance

to the Basel and Bank Negara Malaysia requirements. The new and Operational Risk Officer (DCORO) to ensure

CRP addresses the credit risk governance, alignment of credit risk broad coverage of compliance risk, operational

management with the Board-approved credit risk appetite, the Bank’s and Shariah non-compliance risk identification and

Risk Appetite Statements and its respective credit components. The assessment that may arise from the Bank’s product,

CRP also introduced the Target Market and Risk Acceptance Criteria people, processes and system. The DCOROs also

and the Credit Risk Rating through the Credit Risk Management facilitate for effective management of information

System (CRMS). disclosure from the regulatory authorities for onward

submission to the Chief Compliance Officer, participate

2 in the Business Continuity Management (BCM) related

activities, as well as report the loss event as and when

Establishment of Shariah RCSA, KRI & KCT to inculcate the required, as per the Guidelines on Operational Risk

self-assessment risk awareness and culture among the process and Integrated Online Network (ORION) and Guidelines

risk owners, which includes the identification, assessment, mitigation on Managing Shariah Non-Compliance (SNC) Risk

and monitoring of the Bank’s SNC risk exposures. requirements.

A number of Risk initiatives were initiated in 2020 including Credit Risk Management System and Group Risk Compliance Solution

with targeted implementation in 2021.