Page 77 - Exim iar24_Ebook

P. 77

EXIM BANK MALAYSIA ANNUAL REPORT 2024

6 UPHOLDING ACCOUNTABILITY 75

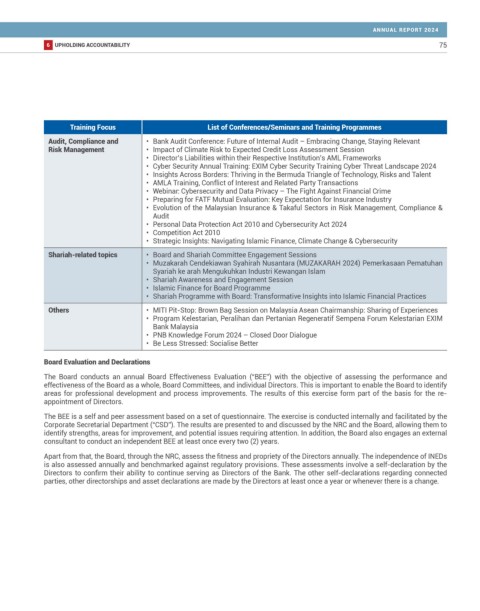

Training Focus List of Conferences/Seminars and Training Programmes

Audit, Compliance and • Bank Audit Conference: Future of Internal Audit – Embracing Change, Staying Relevant

Risk Management • Impact of Climate Risk to Expected Credit Loss Assessment Session

• Director’s Liabilities within their Respective Institution’s AML Frameworks

• Cyber Security Annual Training: EXIM Cyber Security Training Cyber Threat Landscape 2024

• Insights Across Borders: Thriving in the Bermuda Triangle of Technology, Risks and Talent

• AMLA Training, Conflict of Interest and Related Party Transactions

• Webinar: Cybersecurity and Data Privacy – The Fight Against Financial Crime

• Preparing for FATF Mutual Evaluation: Key Expectation for Insurance Industry

• Evolution of the Malaysian Insurance & Takaful Sectors in Risk Management, Compliance &

Audit

• Personal Data Protection Act 2010 and Cybersecurity Act 2024

• Competition Act 2010

• Strategic Insights: Navigating Islamic Finance, Climate Change & Cybersecurity

Shariah-related topics • Board and Shariah Committee Engagement Sessions

• Muzakarah Cendekiawan Syahirah Nusantara (MUZAKARAH 2024) Pemerkasaan Pematuhan

Syariah ke arah Mengukuhkan Industri Kewangan Islam

• Shariah Awareness and Engagement Session

• Islamic Finance for Board Programme

• Shariah Programme with Board: Transformative Insights into Islamic Financial Practices

Others • MITI Pit-Stop: Brown Bag Session on Malaysia Asean Chairmanship: Sharing of Experiences

• Program Kelestarian, Peralihan dan Pertanian Regeneratif Sempena Forum Kelestarian EXIM

Bank Malaysia

• PNB Knowledge Forum 2024 – Closed Door Dialogue

• Be Less Stressed: Socialise Better

Board Evaluation and Declarations

The Board conducts an annual Board Effectiveness Evaluation (“BEE”) with the objective of assessing the performance and

effectiveness of the Board as a whole, Board Committees, and individual Directors. This is important to enable the Board to identify

areas for professional development and process improvements. The results of this exercise form part of the basis for the re-

appointment of Directors.

The BEE is a self and peer assessment based on a set of questionnaire. The exercise is conducted internally and facilitated by the

Corporate Secretarial Department (“CSD”). The results are presented to and discussed by the NRC and the Board, allowing them to

identify strengths, areas for improvement, and potential issues requiring attention. In addition, the Board also engages an external

consultant to conduct an independent BEE at least once every two (2) years.

Apart from that, the Board, through the NRC, assess the fitness and propriety of the Directors annually. The independence of INEDs

is also assessed annually and benchmarked against regulatory provisions. These assessments involve a self-declaration by the

Directors to confirm their ability to continue serving as Directors of the Bank. The other self-declarations regarding connected

parties, other directorships and asset declarations are made by the Directors at least once a year or whenever there is a change.