Page 81 - Exim iar24_Ebook

P. 81

EXIM BANK MALAYSIA ANNUAL REPORT 2024

6 UPHOLDING ACCOUNTABILITY 79

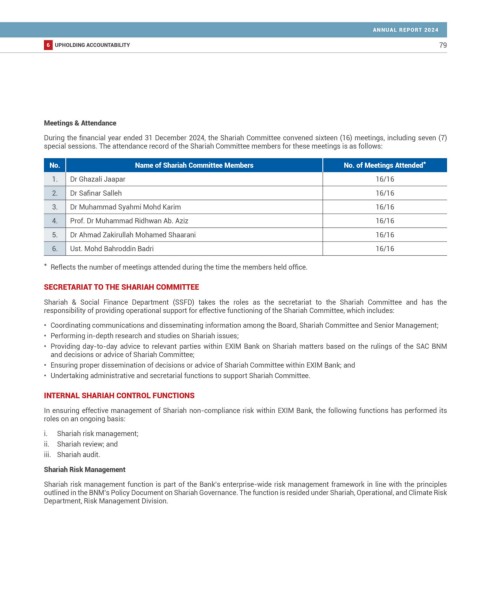

Meetings & Attendance

During the financial year ended 31 December 2024, the Shariah Committee convened sixteen (16) meetings, including seven (7)

special sessions. The attendance record of the Shariah Committee members for these meetings is as follows:

No. Name of Shariah Committee Members No. of Meetings Attended *

1. Dr Ghazali Jaapar 16/16

2. Dr Safinar Salleh 16/16

3. Dr Muhammad Syahmi Mohd Karim 16/16

4. Prof. Dr Muhammad Ridhwan Ab. Aziz 16/16

5. Dr Ahmad Zakirullah Mohamed Shaarani 16/16

6. Ust. Mohd Bahroddin Badri 16/16

* Reflects the number of meetings attended during the time the members held office.

SECRETARIAT TO THE SHARIAH COMMITTEE

Shariah & Social Finance Department (SSFD) takes the roles as the secretariat to the Shariah Committee and has the

responsibility of providing operational support for effective functioning of the Shariah Committee, which includes:

• Coordinating communications and disseminating information among the Board, Shariah Committee and Senior Management;

• Performing in-depth research and studies on Shariah issues;

• Providing day-to-day advice to relevant parties within EXIM Bank on Shariah matters based on the rulings of the SAC BNM

and decisions or advice of Shariah Committee;

• Ensuring proper dissemination of decisions or advice of Shariah Committee within EXIM Bank; and

• Undertaking administrative and secretarial functions to support Shariah Committee.

INTERNAL SHARIAH CONTROL FUNCTIONS

In ensuring effective management of Shariah non-compliance risk within EXIM Bank, the following functions has performed its

roles on an ongoing basis:

i. Shariah risk management;

ii. Shariah review; and

iii. Shariah audit.

Shariah Risk Management

Shariah risk management function is part of the Bank’s enterprise-wide risk management framework in line with the principles

outlined in the BNM’s Policy Document on Shariah Governance. The function is resided under Shariah, Operational, and Climate Risk

Department, Risk Management Division.