Page 86 - Exim iar24_Ebook

P. 86

EXIM BANK MALAYSIA

84

STATEMENT OF

RISK MANAGEMENT

RISK MANAGEMENT PROCESSES

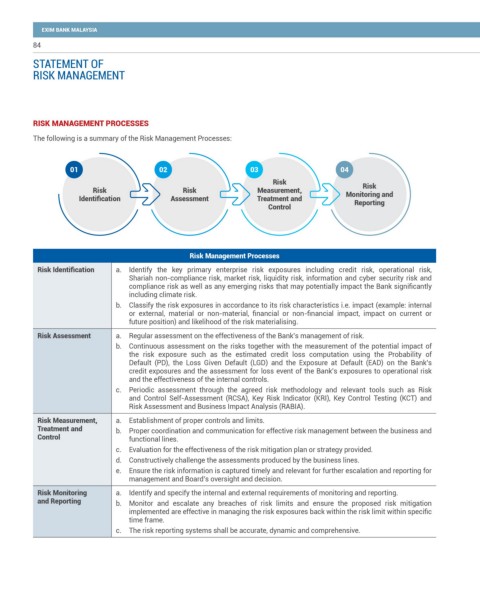

The following is a summary of the Risk Management Processes:

01 02 03 04

Risk

Risk Risk Measurement, Risk

Identification Assessment Treatment and Monitoring and

Reporting

Control

Risk Management Processes

Risk Identification a. Identify the key primary enterprise risk exposures including credit risk, operational risk,

Shariah non-compliance risk, market risk, liquidity risk, information and cyber security risk and

compliance risk as well as any emerging risks that may potentially impact the Bank significantly

including climate risk.

b. Classify the risk exposures in accordance to its risk characteristics i.e. impact (example: internal

or external, material or non-material, financial or non-financial impact, impact on current or

future position) and likelihood of the risk materialising.

Risk Assessment a. Regular assessment on the effectiveness of the Bank’s management of risk.

b. Continuous assessment on the risks together with the measurement of the potential impact of

the risk exposure such as the estimated credit loss computation using the Probability of

Default (PD), the Loss Given Default (LGD) and the Exposure at Default (EAD) on the Bank’s

credit exposures and the assessment for loss event of the Bank’s exposures to operational risk

and the effectiveness of the internal controls.

c. Periodic assessment through the agreed risk methodology and relevant tools such as Risk

and Control Self-Assessment (RCSA), Key Risk Indicator (KRI), Key Control Testing (KCT) and

Risk Assessment and Business Impact Analysis (RABIA).

Risk Measurement, a. Establishment of proper controls and limits.

Treatment and b. Proper coordination and communication for effective risk management between the business and

Control functional lines.

c. Evaluation for the effectiveness of the risk mitigation plan or strategy provided.

d. Constructively challenge the assessments produced by the business lines.

e. Ensure the risk information is captured timely and relevant for further escalation and reporting for

management and Board’s oversight and decision.

Risk Monitoring a. Identify and specify the internal and external requirements of monitoring and reporting.

and Reporting b. Monitor and escalate any breaches of risk limits and ensure the proposed risk mitigation

implemented are effective in managing the risk exposures back within the risk limit within specific

time frame.

c. The risk reporting systems shall be accurate, dynamic and comprehensive.