Page 85 - Exim iar24_Ebook

P. 85

EXIM BANK MALAYSIA ANNUAL REPORT 2024

6 UPHOLDING ACCOUNTABILITY 83

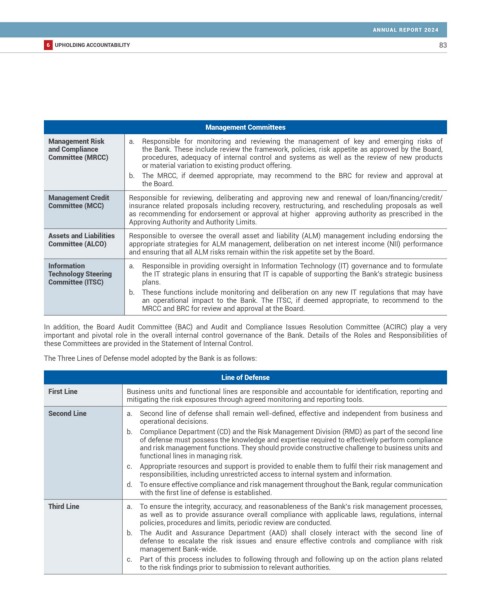

Management Committees

Management Risk a. Responsible for monitoring and reviewing the management of key and emerging risks of

and Compliance the Bank. These include review the framework, policies, risk appetite as approved by the Board,

Committee (MRCC) procedures, adequacy of internal control and systems as well as the review of new products

or material variation to existing product offering.

b. The MRCC, if deemed appropriate, may recommend to the BRC for review and approval at

the Board.

Management Credit Responsible for reviewing, deliberating and approving new and renewal of loan/financing/credit/

Committee (MCC) insurance related proposals including recovery, restructuring, and rescheduling proposals as well

as recommending for endorsement or approval at higher approving authority as prescribed in the

Approving Authority and Authority Limits.

Assets and Liabilities Responsible to oversee the overall asset and liability (ALM) management including endorsing the

Committee (ALCO) appropriate strategies for ALM management, deliberation on net interest income (NII) performance

and ensuring that all ALM risks remain within the risk appetite set by the Board.

Information a. Responsible in providing oversight in Information Technology (IT) governance and to formulate

Technology Steering the IT strategic plans in ensuring that IT is capable of supporting the Bank’s strategic business

Committee (ITSC) plans.

b. These functions include monitoring and deliberation on any new IT regulations that may have

an operational impact to the Bank. The ITSC, if deemed appropriate, to recommend to the

MRCC and BRC for review and approval at the Board.

In addition, the Board Audit Committee (BAC) and Audit and Compliance Issues Resolution Committee (ACIRC) play a very

important and pivotal role in the overall internal control governance of the Bank. Details of the Roles and Responsibilities of

these Committees are provided in the Statement of Internal Control.

The Three Lines of Defense model adopted by the Bank is as follows:

Line of Defense

First Line Business units and functional lines are responsible and accountable for identification, reporting and

mitigating the risk exposures through agreed monitoring and reporting tools.

Second Line a. Second line of defense shall remain well-defined, effective and independent from business and

operational decisions.

b. Compliance Department (CD) and the Risk Management Division (RMD) as part of the second line

of defense must possess the knowledge and expertise required to effectively perform compliance

and risk management functions. They should provide constructive challenge to business units and

functional lines in managing risk.

c. Appropriate resources and support is provided to enable them to fulfil their risk management and

responsibilities, including unrestricted access to internal system and information.

d. To ensure effective compliance and risk management throughout the Bank, regular communication

with the first line of defense is established.

Third Line a. To ensure the integrity, accuracy, and reasonableness of the Bank’s risk management processes,

as well as to provide assurance overall compliance with applicable laws, regulations, internal

policies, procedures and limits, periodic review are conducted.

b. The Audit and Assurance Department (AAD) shall closely interact with the second line of

defense to escalate the risk issues and ensure effective controls and compliance with risk

management Bank-wide.

c. Part of this process includes to following through and following up on the action plans related

to the risk findings prior to submission to relevant authorities.