Page 88 - Exim iar24_Ebook

P. 88

EXIM BANK MALAYSIA

86

STATEMENT OF

RISK MANAGEMENT

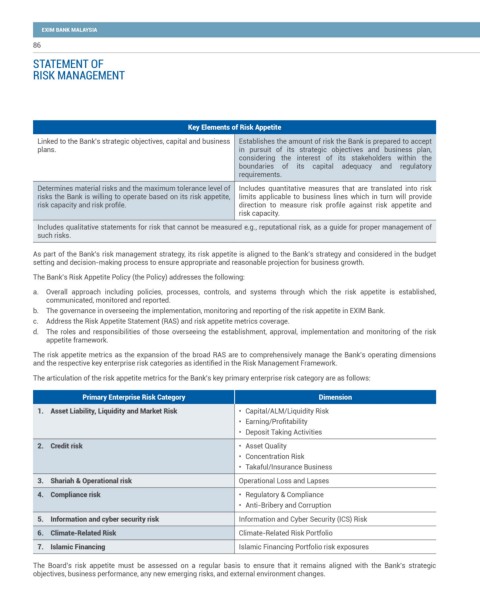

Key Elements of Risk Appetite

Linked to the Bank’s strategic objectives, capital and business Establishes the amount of risk the Bank is prepared to accept

plans. in pursuit of its strategic objectives and business plan,

considering the interest of its stakeholders within the

boundaries of its capital adequacy and regulatory

requirements.

Determines material risks and the maximum tolerance level of Includes quantitative measures that are translated into risk

risks the Bank is willing to operate based on its risk appetite, limits applicable to business lines which in turn will provide

risk capacity and risk profile. direction to measure risk profile against risk appetite and

risk capacity.

Includes qualitative statements for risk that cannot be measured e.g., reputational risk, as a guide for proper management of

such risks.

As part of the Bank’s risk management strategy, its risk appetite is aligned to the Bank’s strategy and considered in the budget

setting and decision-making process to ensure appropriate and reasonable projection for business growth.

The Bank’s Risk Appetite Policy (the Policy) addresses the following:

a. Overall approach including policies, processes, controls, and systems through which the risk appetite is established,

communicated, monitored and reported.

b. The governance in overseeing the implementation, monitoring and reporting of the risk appetite in EXIM Bank.

c. Address the Risk Appetite Statement (RAS) and risk appetite metrics coverage.

d. The roles and responsibilities of those overseeing the establishment, approval, implementation and monitoring of the risk

appetite framework.

The risk appetite metrics as the expansion of the broad RAS are to comprehensively manage the Bank’s operating dimensions

and the respective key enterprise risk categories as identified in the Risk Management Framework.

The articulation of the risk appetite metrics for the Bank’s key primary enterprise risk category are as follows:

Primary Enterprise Risk Category Dimension

1. Asset Liability, Liquidity and Market Risk • Capital/ALM/Liquidity Risk

• Earning/Profitability

• Deposit Taking Activities

2. Credit risk • Asset Quality

• Concentration Risk

• Takaful/Insurance Business

3. Shariah & Operational risk Operational Loss and Lapses

4. Compliance risk • Regulatory & Compliance

• Anti-Bribery and Corruption

5. Information and cyber security risk Information and Cyber Security (ICS) Risk

6. Climate-Related Risk Climate-Related Risk Portfolio

7. Islamic Financing Islamic Financing Portfolio risk exposures

The Board’s risk appetite must be assessed on a regular basis to ensure that it remains aligned with the Bank’s strategic

objectives, business performance, any new emerging risks, and external environment changes.