Page 89 - Exim iar24_Ebook

P. 89

EXIM BANK MALAYSIA ANNUAL REPORT 2024

6 UPHOLDING ACCOUNTABILITY 87

STRESS TEST

To anticipate and respond swiftly to the new or emerging risks, the Bank perform stress tests as part of the risk management

process. The results are integrated into the decision making and regularly reviewed against actual performance versus the risk

estimation (back-testing).

The stress testing exercise must be comprehensive and include both on and off-balance sheet exposures, commitments,

guarantees, and contingent liabilities as well as other risk drivers on credit, market, operational and Shariah risk. The exercise

must also commensurate with the nature, size and complexity of the Bank’s business operations and risk profile.

Further to the above, the reverse stress testing was also conducted in accordance with the requirements outlined in the BNM’s

Policy Document on Stress Testing.

In addition, the BNM Climate Risk Stress Testing Exercise (CRST) Methodology Paper specified the elements such as time horizon

and technical elements such as scenario selection and counterparty assessment selection. The Methodology Paper further details

the applicability of the exercise, the portfolio scope and granularity and the completion timeline.

As stress test is a continuous process, RMD will continuously strive for improvement on the stress test exercise by exploring

potential areas for enhancements as well as establishing linkages between stress test to the risk appetite metrics moving

forward.

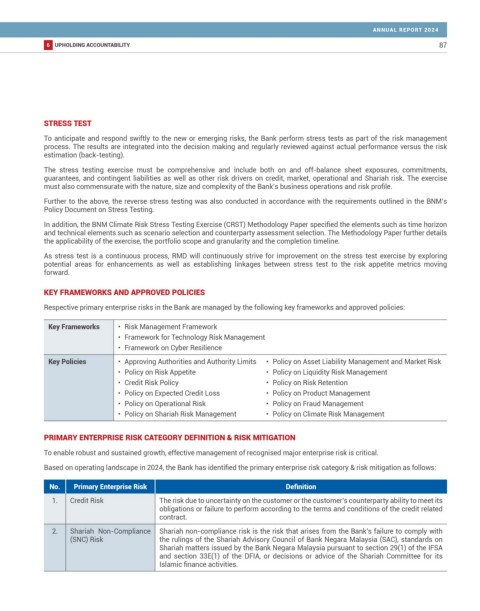

KEY FRAMEWORKS AND APPROVED POLICIES

Respective primary enterprise risks in the Bank are managed by the following key frameworks and approved policies:

Key Frameworks • Risk Management Framework

• Framework for Technology Risk Management

• Framework on Cyber Resilience

Key Policies • Approving Authorities and Authority Limits • Policy on Asset Liability Management and Market Risk

• Policy on Risk Appetite • Policy on Liquidity Risk Management

• Credit Risk Policy • Policy on Risk Retention

• Policy on Expected Credit Loss • Policy on Product Management

• Policy on Operational Risk • Policy on Fraud Management

• Policy on Shariah Risk Management • Policy on Climate Risk Management

PRIMARY ENTERPRISE RISK CATEGORY DEFINITION & RISK MITIGATION

To enable robust and sustained growth, effective management of recognised major enterprise risk is critical.

Based on operating landscape in 2024, the Bank has identified the primary enterprise risk category & risk mitigation as follows:

No. Primary Enterprise Risk Definition

1. Credit Risk The risk due to uncertainty on the customer or the customer’s counterparty ability to meet its

obligations or failure to perform according to the terms and conditions of the credit related

contract.

2. Shariah Non-Compliance Shariah non-compliance risk is the risk that arises from the Bank’s failure to comply with

(SNC) Risk the rulings of the Shariah Advisory Council of Bank Negara Malaysia (SAC), standards on

Shariah matters issued by the Bank Negara Malaysia pursuant to section 29(1) of the IFSA

and section 33E(1) of the DFIA, or decisions or advice of the Shariah Committee for its

Islamic finance activities.