Page 84 - Exim iar24_Ebook

P. 84

EXIM BANK MALAYSIA

82

STATEMENT OF

RISK MANAGEMENT

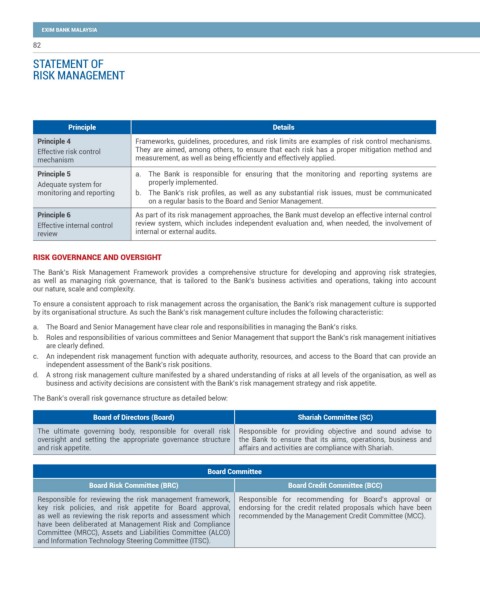

Principle Details

Principle 4 Frameworks, guidelines, procedures, and risk limits are examples of risk control mechanisms.

Effective risk control They are aimed, among others, to ensure that each risk has a proper mitigation method and

mechanism measurement, as well as being efficiently and effectively applied.

Principle 5 a. The Bank is responsible for ensuring that the monitoring and reporting systems are

Adequate system for properly implemented.

monitoring and reporting b. The Bank’s risk profiles, as well as any substantial risk issues, must be communicated

on a regular basis to the Board and Senior Management.

Principle 6 As part of its risk management approaches, the Bank must develop an effective internal control

Effective internal control review system, which includes independent evaluation and, when needed, the involvement of

review internal or external audits.

RISK GOVERNANCE AND OVERSIGHT

The Bank’s Risk Management Framework provides a comprehensive structure for developing and approving risk strategies,

as well as managing risk governance, that is tailored to the Bank’s business activities and operations, taking into account

our nature, scale and complexity.

To ensure a consistent approach to risk management across the organisation, the Bank’s risk management culture is supported

by its organisational structure. As such the Bank’s risk management culture includes the following characteristic:

a. The Board and Senior Management have clear role and responsibilities in managing the Bank’s risks.

b. Roles and responsibilities of various committees and Senior Management that support the Bank’s risk management initiatives

are clearly defined.

c. An independent risk management function with adequate authority, resources, and access to the Board that can provide an

independent assessment of the Bank’s risk positions.

d. A strong risk management culture manifested by a shared understanding of risks at all levels of the organisation, as well as

business and activity decisions are consistent with the Bank’s risk management strategy and risk appetite.

The Bank’s overall risk governance structure as detailed below:

Board of Directors (Board) Shariah Committee (SC)

The ultimate governing body, responsible for overall risk Responsible for providing objective and sound advise to

oversight and setting the appropriate governance structure the Bank to ensure that its aims, operations, business and

and risk appetite. affairs and activities are compliance with Shariah.

Board Committee

Board Risk Committee (BRC) Board Credit Committee (BCC)

Responsible for reviewing the risk management framework, Responsible for recommending for Board’s approval or

key risk policies, and risk appetite for Board approval, endorsing for the credit related proposals which have been

as well as reviewing the risk reports and assessment which recommended by the Management Credit Committee (MCC).

have been deliberated at Management Risk and Compliance

Committee (MRCC), Assets and Liabilities Committee (ALCO)

and Information Technology Steering Committee (ITSC).