Page 188 - EXIM_AR2021

P. 188

186 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

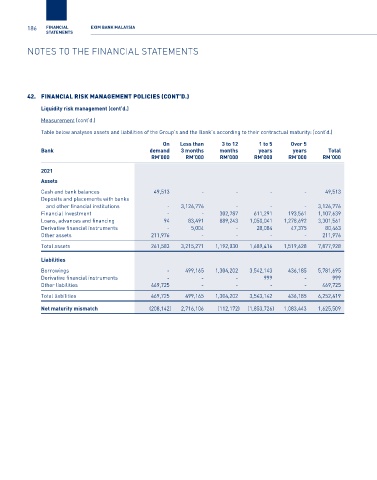

42. financial risk management POlicies (cOnt’D.)

Liquidity risk management (cont’d.)

Measurement (cont’d.)

Table below analyses assets and liabilities of the Group’s and the Bank’s according to their contractual maturity: (cont’d.)

On Less than 3 to 12 1 to 5 Over 5

Bank demand 3 months months years years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2021

Assets

Cash and bank balances 49,513 - - - - 49,513

Deposits and placements with banks

and other financial institutions - 3,126,776 - - - 3,126,776

Financial Investment - - 302,787 611,291 193,561 1,107,639

Loans, advances and financing 94 83,491 889,243 1,050,041 1,278,692 3,301,561

Derivative financial instruments - 5,004 - 28,084 47,375 80,463

Other assets 211,976 - - - - 211,976

Total assets 261,583 3,215,271 1,192,030 1,689,416 1,519,628 7,877,928

Liabilities

Borrowings - 499,165 1,304,202 3,542,143 436,185 5,781,695

Derivative financial instruments - - - 999 - 999

Other liabilities 469,725 - - - - 469,725

Total liabilities 469,725 499,165 1,304,202 3,543,142 436,185 6,252,419

Net maturity mismatch (208,142) 2,716,106 (112,172) (1,853,726) 1,083,443 1,625,509