Page 187 - EXIM_AR2021

P. 187

ANNUAL REPORT 2021 185

Notes to the fiNaNcial statemeNts

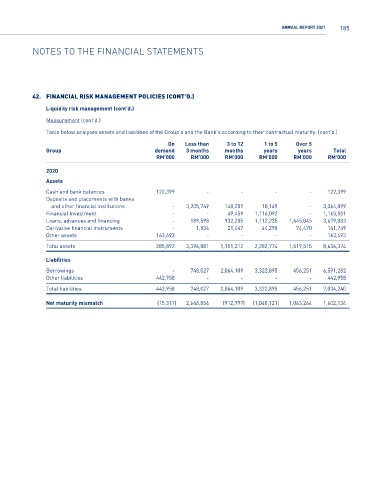

42. financial risk management POlicies (cOnt’D.)

Liquidity risk management (cont’d.)

Measurement (cont’d.)

Table below analyses assets and liabilities of the Group’s and the Bank’s according to their contractual maturity: (cont’d.)

On Less than 3 to 12 1 to 5 Over 5

Group demand 3 months months years years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2020

Assets

Cash and bank balances 122,399 - - - - 122,399

Deposits and placements with banks

and other financial institutions - 3,205,749 148,201 10,149 - 3,364,099

Financial Investment - - 49,459 1,116,092 - 1,165,551

Loans, advances and financing - 189,598 932,205 1,112,235 1,445,045 3,679,083

Derivative financial instruments - 1,534 21,447 44,298 74,470 141,749

Other assets 163,493 - - - - 163,493

Total assets 285,892 3,396,881 1,151,312 2,282,774 1,519,515 8,636,374

Liabilities

Borrowings - 748,027 2,064,109 3,322,895 456,251 6,591,282

Other liabilities 442,958 - - - - 442,958

Total liabilities 442,958 748,027 2,064,109 3,322,895 456,251 7,034,240

Net maturity mismatch (15,317) 2,648,854 (912,797) (1,040,121) 1,063,264 1,602,134