Page 183 - EXIM_AR2021

P. 183

ANNUAL REPORT 2021 181

Notes to the fiNaNcial statemeNts

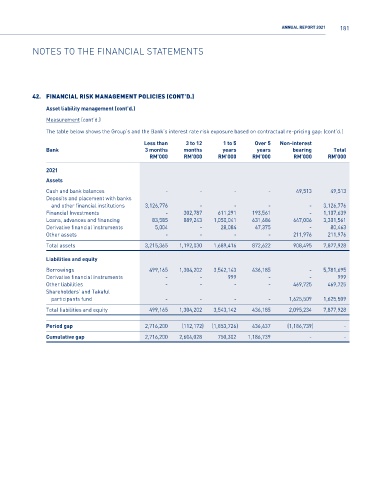

42. financial risk management POlicies (cOnt’D.)

Asset liability management (cont’d.)

Measurement (cont’d.)

The table below shows the Group’s and the Bank’s interest rate risk exposure based on contractual re-pricing gap: (cont’d.)

Less than 3 to 12 1 to 5 Over 5 Non-interest

Bank 3 months months years years bearing Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2021

Assets

Cash and bank balances - - - - 49,513 49,513

Deposits and placement with banks

and other financial institutions 3,126,776 - - - - 3,126,776

Financial Investments - 302,787 611,291 193,561 - 1,107,639

Loans, advances and financing 83,585 889,243 1,050,041 631,686 647,006 3,301,561

Derivative financial instruments 5,004 - 28,084 47,375 - 80,463

Other assets - - - - 211,976 211,976

Total assets 3,215,365 1,192,030 1,689,416 872,622 908,495 7,877,928

Liabilities and equity

Borrowings 499,165 1,304,202 3,542,143 436,185 - 5,781,695

Derivative financial instruments - - 999 - - 999

Other liabilities - - - - 469,725 469,725

Shareholders’ and Takaful

participants fund - - - - 1,625,509 1,625,509

Total liabilities and equity 499,165 1,304,202 3,543,142 436,185 2,095,234 7,877,928

Period gap 2,716,200 (112,172) (1,853,726) 436,437 (1,186,739) -

Cumulative gap 2,716,200 2,604,028 750,302 1,186,739 - -