Page 182 - EXIM_AR2021

P. 182

180 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

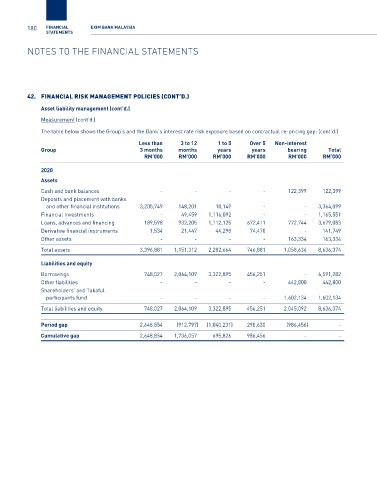

42. financial risk management POlicies (cOnt’D.)

Asset liability management (cont’d.)

Measurement (cont’d.)

The table below shows the Group’s and the Bank’s interest rate risk exposure based on contractual re-pricing gap: (cont’d.)

Less than 3 to 12 1 to 5 Over 5 Non-interest

Group 3 months months years years bearing Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2020

Assets

Cash and bank balances - - - - 122,399 122,399

Deposits and placement with banks

and other financial institutions 3,205,749 148,201 10,149 - - 3,364,099

Financial Investments - 49,459 1,116,092 - - 1,165,551

Loans, advances and financing 189,598 932,205 1,112,125 672,411 772,744 3,679,083

Derivative financial instruments 1,534 21,447 44,298 74,470 - 141,749

Other assets - - - - 163,334 163,334

Total assets 3,396,881 1,151,312 2,282,664 746,881 1,058,636 8,636,374

Liabilities and equity

Borrowings 748,027 2,064,109 3,322,895 456,251 - 6,591,282

Other liabilities - - - - 442,800 442,800

Shareholders’ and Takaful

participants fund - - - - 1,602,134 1,602,134

Total liabilities and equity 748,027 2,064,109 3,322,895 456,251 2,045,092 8,636,374

Period gap 2,648,854 (912,797) (1,040,231) 290,630 (986,456) -

Cumulative gap 2,648,854 1,736,057 695,826 986,456 - -