Page 186 - EXIM_AR2021

P. 186

184 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

42. financial risk management POlicies (cOnt’D.)

Liquidity risk management (cont’d.)

Risk identification

There are two types of liquidity risk i.e. funding liquidity risk and market liquidity risk. Funding liquidity risk refers to the potential

inability of the Group and the Bank to meet its funding requirements arising from cash flow mismatches at a reasonable cost.

Market liquidity risk refers to the Group’s and the Bank’s potential inability to liquidate positions quickly and in sufficient

volumes, at a reasonable price.

Measurement

Liquidity is measured by the Group’s and the Bank’s ability to efficiently and economically accommodate decrease in deposits/

funding (such as funds obtained from the Government) and other purchased liabilities and to fund increases in assets to ensure

continued growth of the Group and the Bank.

The Group and the Bank maintain large capital base, sufficient liquid assets, diversified funding sources, and regularly

assesses the long-standing relationship with traditional fund providers. These processes are subject to regular reviews to

ensure adequacy and appropriateness.

In addition, the Group’s and the Bank’s liquidity positions are monitored and managed through structural liquidity indicators,

such as loan to purchase funds and offshore revolving funds utilisation rate ratios to maintain an optimal funding mix and

asset composition.

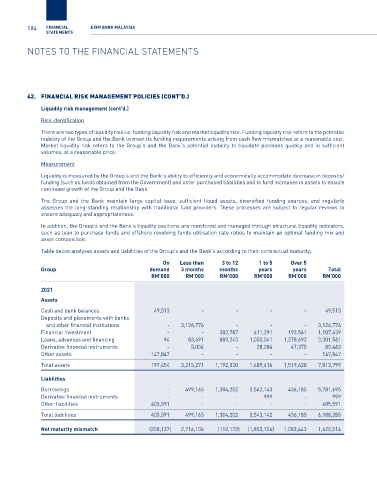

Table below analyses assets and liabilities of the Group’s and the Bank’s according to their contractual maturity:

On Less than 3 to 12 1 to 5 Over 5

Group demand 3 months months years years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2021

Assets

Cash and bank balances 49,513 - - - - 49,513

Deposits and placements with banks

and other financial institutions - 3,126,776 - - - 3,126,776

Financial Investment - - 302,787 611,291 193,561 1,107,639

Loans, advances and financing 94 83,491 889,243 1,050,041 1,278,692 3,301,561

Derivative financial instruments - 5,004 - 28,084 47,375 80,463

Other assets 147,847 - - - - 147,847

Total assets 197,454 3,215,271 1,192,030 1,689,416 1,519,628 7,813,799

Liabilities

Borrowings - 499,165 1,304,202 3,542,143 436,185 5,781,695

Derivative financial instruments - - - 999 - 999

Other liabilities 405,591 - - - - 405,591

Total liabilities 405,591 499,165 1,304,202 3,543,142 436,185 6,188,285

Net maturity mismatch (208,137) 2,716,106 (112,172) (1,853,726) 1,083,443 1,625,514