Page 209 - EXIM-Bank_Annual-Report-2022

P. 209

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 207

Notes to the fiNaNcial statemeNts

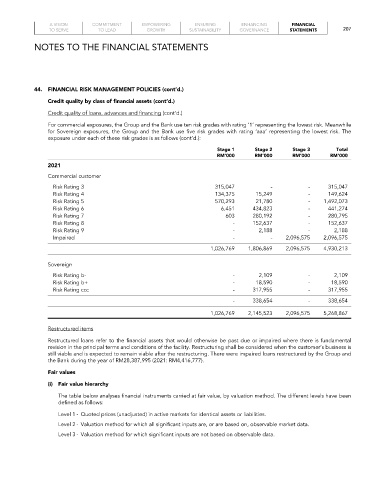

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

Credit quality by class of financial assets (cont’d.)

Credit quality of loans, advances and financing (cont’d.)

For commercial exposures, the Group and the Bank use ten risk grades with rating ‘1’ representing the lowest risk. Meanwhile

for Sovereign exposures, the Group and the Bank use five risk grades with rating ‘aaa’ representing the lowest risk. The

exposure under each of these risk grades is as follows (cont’d.):

stage 1 stage 2 stage 3 total

rM’000 rM’000 rM’000 rM’000

2021

Commercial customer

Risk Rating 3 315,047 - - 315,047

Risk Rating 4 134,375 15,249 - 149,624

Risk Rating 5 570,293 21,780 - 1,492,073

Risk Rating 6 6,451 434,823 - 441,274

Risk Rating 7 603 280,192 - 280,795

Risk Rating 8 - 152,637 - 152,637

Risk Rating 9 - 2,188 - 2,188

Impaired - - 2,096,575 2,096,575

1,026,769 1,806,869 2,096,575 4,930,213

Sovereign

Risk Rating b- - 2,109 - 2,109

Risk Rating b+ - 18,590 - 18,590

Risk Rating ccc - 317,955 - 317,955

- 338,654 - 338,654

1,026,769 2,145,523 2,096,575 5,268,867

Restructured items

Restructured loans refer to the financial assets that would otherwise be past due or impaired where there is fundamental

revision in the principal terms and conditions of the facility. Restructuring shall be considered when the customer’s business is

still viable and is expected to remain viable after the restructuring. There were impaired loans restructured by the Group and

the Bank during the year of RM28,387,995 (2021: RM4,416,777).

Fair values

(i) Fair value hierarchy

The table below analyses financial instruments carried at fair value, by valuation method. The different levels have been

defined as follows:

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 - Valuation method for which all significant inputs are, or are based on, observable market data.

Level 3 - Valuation method for which significant inputs are not based on observable data.