Page 207 - EXIM-Bank_Annual-Report-2022

P. 207

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 205

Notes to the fiNaNcial statemeNts

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

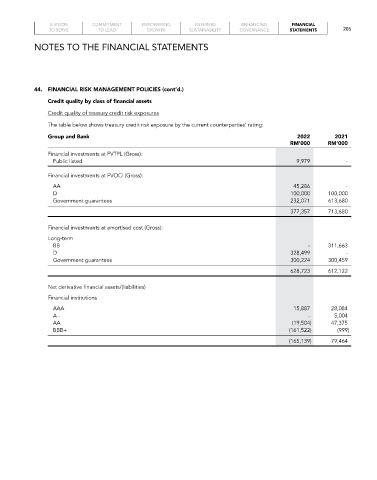

Credit quality by class of financial assets

Credit quality of treasury credit risk exposures

The table below shows treasury credit risk exposure by the current counterparties’ rating:

Group and Bank 2022 2021

rM’000 rM’000

Financial investments at FVTPL (Gross):

Public listed 9,979 -

Financial investments at FVOCI (Gross):

AA 45,286 -

D 100,000 100,000

Government guarantees 232,071 613,680

377,357 713,680

Financial investments at amortised cost (Gross):

Long-term

BB - 311,663

D 328,499 -

Government guarantees 300,224 300,459

628,723 612,122

Net derivative financial assets/(liabilities)

Financial institutions

AAA 15,887 28,084

A - - 5,004

AA (19,504) 47,375

BBB+ (161,522) (999)

(165,139) 79,464