Page 206 - EXIM-Bank_Annual-Report-2022

P. 206

204 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

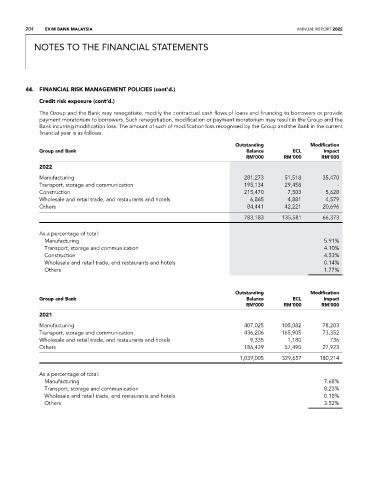

44. FINaNCIaL RISk MaNaGEMENT POLICIES (cont’d.)

Credit risk exposure (cont’d.)

The Group and the Bank may renegotiate, modify the contractual cash flows of loans and financing to borrowers or provide

payment moratorium to borrowers. Such renegotiation, modification or payment moratorium may result in the Group and the

Bank incurring modification loss. The amount of such of modification loss recognised by the Group and the Bank in the current

financial year is as follows:

Outstanding Modification

Group and Bank Balance eCL Impact

rM’000 rM’000 rM’000

2022

Manufacturing 281,273 51,518 35,470

Transport, storage and communication 195,134 29,458 -

Construction 215,470 7,503 5,628

Wholesale and retail trade, and restaurants and hotels 6,865 4,881 4,579

Others 84,441 42,221 20,696

783,183 135,581 66,373

As a percentage of total:

Manufacturing 5.91%

Transport, storage and communication 4.10%

Construction 4.53%

Wholesale and retail trade, and restaurants and hotels 0.14%

Others 1.77%

Outstanding Modification

Group and Bank Balance eCL Impact

rM’000 rM’000 rM’000

2021

Manufacturing 407,025 105,082 78,203

Transport, storage and communication 436,206 165,905 73,352

Wholesale and retail trade, and restaurants and hotels 9,335 1,180 736

Others 186,439 57,490 27,923

1,039,005 329,657 180,214

As a percentage of total:

Manufacturing 7.68%

Transport, storage and communication 8.23%

Wholesale and retail trade, and restaurants and hotels 0.18%

Others 3.52%