Page 53 - EXIM-BANK-AR20

P. 53

Section 05 Upholding Accountability

51

SPECIFIC DISCLOSURE ON

DEVELOPMENTAL PERFORMANCE

PERFORMANCE MANAGEMENT FRAMEWORK INITIATIVE EXIM Bank noticed that one of the purposes of a

DFI is to assist the underserved in this segment.

The latter is defined as companies who find it hard

1.0 BACKGROUND

to obtain financing for their cross-border ventures,

The Performance Management Framework (PMF) is an due to reasons such as being a new exporter or the

outcome-based management tool, which acts as a guide country that they are venturing is of an unfamiliar

in developing and evaluating the Bank’s performance territory. In this context, EXIM Bank has extended

in delivering its mandate. PMF’s key differentiator its financial assistance to the underserved worth

is its robustness, where it measures performance RM359 million, higher than the initial target of

beyond conventional financial indicators by factoring in RM325 million.

the socio-economic impact of Development Financial

Institutions (DFIs). In addition to the above, EXIM Bank is not supposed

to compete with commercial financial institutions.

The development of PMF was done in collaboration Having said that, if one of the Bank’s customer has

with the World Bank Group (WBG) during the “Forum been approached or is thinking of switching to a

on Results Measurement for DFIs” on the 9th and 10th commercial financial institution, EXIM Bank sees

of August 2018, which was participated by all the DFIs it as an upward migration since the customer’s

in Malaysia. The initiative was kickstarted in October reputation, as well as credit standing, is bankable

2016 through the establishment of a cross-functional enough. All this was achieved with the initial push

taskforce. The PMF would be centred on the principles or assistance from EXIM Bank. In 2020, EXIM

of additionality with the following main purposes: Bank set a target for RM388 million, and achieved

RM497 million for this.

• Sharpen DFIs focus towards delivering

socio-economic outcomes and development and 2.2 EXIM Bank’s Support to Non-Traditional Market

• Create a consistent and structured performance During EXIM Bank’s first decade of operations,

measurement approach across all DFIs. its focus was to help facilitate the exports of

Malaysian made goods and services, with the

In December 2017, the taskforce produced a report emphasis to promote international trade with

outlining a strategic review of the prescribed DFIs in developing countries, as well as supporting Malaysian

Malaysia with the following indicators on three (3) main companies participating in reverse investment

areas to ensure the DFIs remain sustainable and relevant. projects, particularly in non-traditional markets.

While there is no single internationally-recognised

2.0 CURRENT PMF MEASUREMENT

definition of non-traditional markets, more often

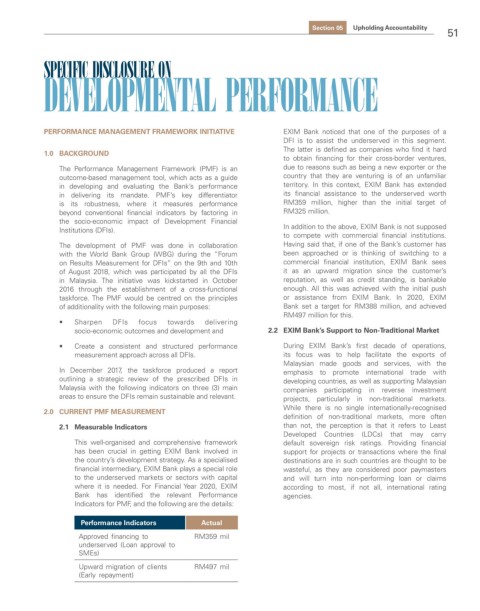

2.1 Measurable Indicators than not, the perception is that it refers to Least

Developed Countries (LDCs) that may carry

This well-organised and comprehensive framework default sovereign risk ratings. Providing financial

has been crucial in getting EXIM Bank involved in support for projects or transactions where the final

the country’s development strategy. As a specialised destinations are in such countries are thought to be

financial intermediary, EXIM Bank plays a special role wasteful, as they are considered poor paymasters

to the underserved markets or sectors with capital and will turn into non-performing loan or claims

where it is needed. For Financial Year 2020, EXIM according to most, if not all, international rating

Bank has identified the relevant Performance agencies.

Indicators for PMF, and the following are the details:

Performance Indicators Actual

Approved financing to RM359 mil

underserved (Loan approval to

SMEs)

Upward migration of clients RM497 mil

(Early repayment)